Bitcoin Venture Capital Reaches All-Time High According to New Report

In 2015, Bitcoin and blockchain companies closed 74 deals, raising a total of $474 million USD in venture capital, an all-time high, according to a new report by CB Insights and KPMG. The three largest deals in the bitcoin space were also the three first Series C funding rounds, suggesting that the venture capital space is continuing to mature to....

Related News

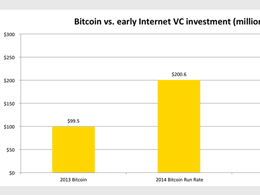

CoinDesk State of Bitcoin Q1 2014 from CoinDesk. Download the full report in PDF form. View more of CoinDesk's Research Reports here. Much has happened since CoinDesk released its first State of Bitcoin report earlier this year and today we are publishing an update featuring brand new data and analysis. We were blown away by the success of the first report, which, at the time of writing, had over 110,000 views on SlideShare. So thank you for taking the time to read and share it across your networks. The new report focuses on data and events in the first quarter of 2014 through to the....

Even though venture capital inflows into the blockchain industry dropped by 66% in Q3 2022, it doesn’t necessarily suggest an overwhelmingly bearish sentiment. In 2022, it’s no surprise that most assets are in a bear market. People have a variety of signals they look for when determining a good time to enter the market, and Cointelegraph Research’s Venture Capital Report for Q2 revealed that VC inflows stagnated at just above $14 billion last quarter, the same as Q1.However, the third quarter did not fare as well, dropping over 66% to just $4.98 billion, as Cointelegraph Research explores....

CoinDesk is releasing its 'State of Bitcoin 2014' report on Tuesday, which takes an in-depth look into the evolution of bitcoin and the potential hurdles it is still yet to face. This article is the first of a two-part series drawn from the report. The series looks at the trends in venture capital investment in bitcoin. It assesses how venture investment in bitcoin to date compares with other related investment sectors (eg financial technology), or previous major waves of investment (eg the Internet). It also examines the types of Bitcoin companies venture investors have focused their....

In addition to the companies listed below, sales portal BitSimple has raised $600,000 in a bitcoin-only seed round. This article summarizes some of the new State of Bitcoin 2014 data and analysis on venture capital investment presented at last week's Coinsummit conference in San Francisco. Several significant venture capital investments in bitcoin startups have been announced in recent weeks, including Circle's $17m second round, Xapo's $20m first round, and OKCoin's $10m first round (Table 1). Table 1: Bitcoin Venture Capital Investments - 2014 YTD. Sources: CoinDesk, Dow Jones....

Cryptocurrency investigation firm Chainalysis expects to raise $100 million in venture capital at a $1 billion valuation as early as next week, the company told Forbes.