Bitcoin Alternative DNotes Focuses On Banking Solutions And Stability While Venture Capital Investment Continues At Record Breaking Pace

Bitcoin high volatilities may have resulted in a slow down in adoption of the currency by large merchants, but venture capital funding continues to pour in at record breaking pace. Meanwhile, DNotes remained as one of the most stable digital currencies with strong focus in providing Banking Solutions and Long Term Appreciation, attracting many new investors.

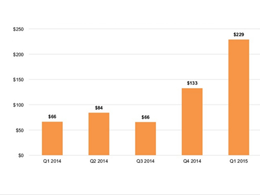

There is an inherent tendency for promising emerging technologies to be deceptive at the formative stage, especially when perceived to be highly disruptive. According to DNotes Co-Founder Alan Yong, a well regarded pioneer and visionary during the early days of mobile computers, this has clearly been the case with Bitcoin, despite often being described as the greatest technology innovation since the Internet. The Bitcoin space has received a staggering investment of almost $500 million from Venture Capital funding in 2014 alone, followed by over $200 million, so far this year.

Incumbents, who are the most direct targets of the disruption, often discount Bitcoin as a threat because of its explosive volatility and poor track record as a store of value. Bitcoin as a medium of exchange has not gained meaningful traction either. In such an environment, the immensely promising Bitcoin with the potential to be the greatest technology revolution of our generation can be quite deceptive; causing many to look back a few years from now wondering how they could have missed the early promising signs.

DNotes can best be characterized, as a second generation Bitcoin alternative digital currency. It objectively studied Bitcoin’s strengths and weaknesses as well as threats and opportunities. DNotes was created on February 18, 2014 with an objective to meet the full functions of fiat currency as a unit of account, store of value and medium of exchange within three years. It decided to take a very different path since day one in building a trustworthy stable digital currency with reliable long term appreciation.

Central to DNotes long term strategic plan is the creation of highly scalable building blocks, as the foundation of its own ecosystem. Those strategic building blocks include CryptoMoms; a currency neutral site dedicated to encourage women participation, DNotesVault; a free secure storage for DNotes’ stakeholders with 100% deposit guarantee with verifiable funds, and CRISPs; a family of Cryptocurrency Investment Savings Plans for everyone worldwide. The core mission of CRISP is to make the savings opportunity available to everyone; from the unborn to the most senior; from the unbanked to the super rich. The opportunity for anyone to participate irrespective of financial standing, coupled with combined charity efforts will bring about much needed financial freedom for millions worldwide.

Yong explained that,

“winning strategies are most effective when executed flawlessly in the right sequence and at the most opportune time. Until there is a stable digital currency everyone can understand, trust and feel comfortable about, attempts to promote it as a medium of exchange will cost more harm than good. In the case of DNotes, the medium of exchange function will not kick until its third year; at which time many small business owners and their employees are anticipated to be DNotes stakeholders and participants in one of its cryptocurrency savings plans.”

DNotes’ ecosystem is strategically linked and systematically executed towards the ultimate goal of mass consumer and mass merchant adoption of DNotes as a medium of exchange in global commerce. As a digital currency it is equal to and better than fiat currency and as a technology it holds enormous power to cause a quantum shift with world changing implications.

DNotes is a cryptographically created digital currency based on a novel decentralized peer to peer model, where trust is replaced by mathematical algorithms, eliminating the need of an intermediary such as a bank or an automatic clearing house. Assets of value such as Bitcoin, DNotes, and other digital assets can be sent and received in minutes anytime, anywhere, worldwide without the oversight of any central authority. It takes as little as two simple cell phones, or computers with an internet connection to send and receive funds. It does not require, transmit, or store any personal information and the two parties do not need to know or trust each other to successfully complete the transaction at little to no cost.

The world we live in has always been dynamic, constantly reacting and adjusting to the needs for change. What we could be underestimating this time is the massive potential for job and wealth creation. We are already living in a hyperconnected world with super-computing power at our finger tips. Over five billion people will be online equipped with significantly more powerful computing power by 2020. Technologies have always been ahead of regulations. This time around the speed of an accommodating regulatory environment to promote rather than to stifle the greatest innovation since the Internet could be the greatest competitive edge among nations. Bitcoin as a digital currency coupled with the immense power of the Blockchain is the solution to many global problems confronting mankind today. There may not be another global opportunity of this magnitude a single nation can exploit to gain an enormous advantage.

For more information about DNotes cryptocurrency please visit: http://dnotescoin.com/

To visit DNotesVault please go to: http://dnotesvault.com/

To visit CryptoMoms please go to: http://cryptomoms.com/

To trade Bitcoin with DNotes please go to: https://poloniex.com/exchange#btc_note

Related News