Algorithmic Arbitrage Now Provided by Coinado.com

Mercury Digital Partners announces algorithmic arbitrage and account management services through its subsidiary Coinado.com.

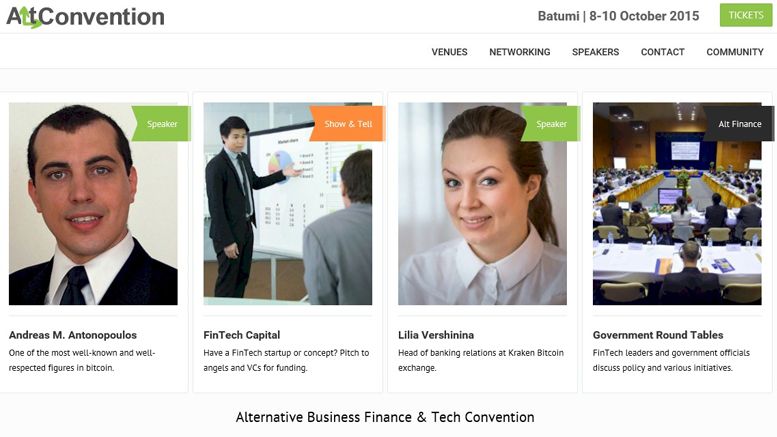

Mercury Digital Partners Inc, a leading automated trading solution provider in digital currency, is proud to announce its first automated trading and management service at Coinado.com. Coinado provides algorithmic trade services to accounts on Bitfinex, Kraken, Bitstamp, and Btc-e. More exchanges are planned to be supported in the future.

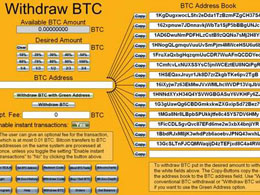

Coinado.com will provide first class managed accounts at the top bitcoin exchanges in the world through its proprietary trading strategies. Accounts at bitcoin exchanges are owned entirely by the client, and permission to trade inside these accounts is granted to Coinado.com via API keys that allow for trade but not withdrawal or deposit. Coinado provides a full user interface to securely track returns, see daily balances, manage fund allocations, and pay fees associated with the service. All of these services are provided while our system provides highest in class latency to the major exchanges due to proprietary hardware and colocation with Level 3 backbone (5-8ms on average).

About Coinado

Coinado’s management strategy is algorithmic statistical arbitrage. An elaboration on its strategy can be found on Coinado.com/faq. In short Coinado requires two or more digital currency exchange accounts connected to its central server, and will book market neutral trades on behalf of the client in order to profit off of market volatility. Coinado operates as software as a service, and requires its clients to pay monthly invoices resulting from fees due to trades profitably booked. Coinado does not take bitcoin’s change in value as its own performance. Average returns vary month to month but range from 2 to 5 % monthly.

For more information about Coinado please visit: https://coinado.com/

About Mercury Digital Partners

Mercury Digital Partners is a leading group of traders and programmers dedicated to providing algorithmic trading solutions as software to a range of clients from small bitcoin investors to large institutions who wishes to maintain 100% custody of their digital currency.

Mercury Digital Partners is run by CEO Aaron Zirker, a digital currency trader since 2011 who has profitably arbitraged multiple millions of BTC/USD through automated systems. The Mercury team is filled with industry professionals from leaders in traditional banking and foreign currency trading as well as experienced programmers from the digital trading world.

For bios and more information please visit: http://Mercurydigitalpartners.com/

Related News