Coinut Launches Bitcoin Options Exchange

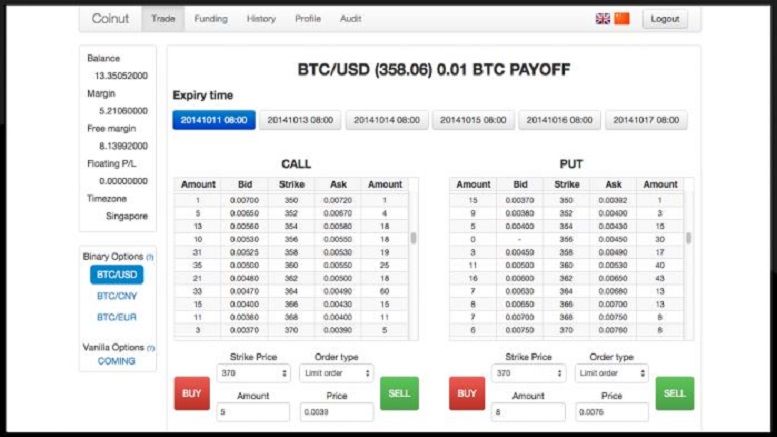

The Coinut team has created the first real Bitcoin options trading exchange. Coinut gives users the opportunity to hedge against the volatility of Bitcoin price. Until now no one has created a true Bitcoin options exchange that gives users the ability to hedge Bitcoin for up to 2 months.

Bitcoin options trading has been seen as one of the missing parts of the Bitcoin ecosystem. There are dozens of Bitcoin to fiat exchanges, services, POS, and wallets. Many people who believe in Bitcoin would like to keep their Bitcoin as Bitcoin and be able to hedge against volatility. Options trading gives traders the ability to profit with market volatility.

“Options is an indispensable part of the Bitcoin world. They are attractive nonlinear speculation tools for you to make profit on Bitcoin price, and they are also the ultimate risk hedging tools for you to handle the high volatility of Bitcoins.” Xinxi Wang

Coinut offers European style Vanilla and Binary options for traders. Differing from other Binary option sites, their Binary options also give the freedom of choosing different strike prices. Coinut offers a global trading platform available in English and Chinese.

Coinut is currently part of Boost VC in San Mateo California. Boost VC concludes with demo day taking place on October 6th, 2015.

Related News