Bitcoin Volatility - The 4 perspectives

Bitcoin exchange rate volatility affects everybody who uses Bitcoin as a currency or trades it as an asset. Hoewever, the available material about Bitcoin volatility is limited. Therefore it's time for some investigation. The results are somewhat counter-intuitive. That makes the whole topic even more worthwile. 1. What is Bitcoin volatility. For any....

Related News

Bitcoin’s volatility is going crazy as the price dropped down 20% to $43k today, right after a week of shockingly low activity! Bitcoin 7-Day Volatility Declined To 2.3% Last Week As per the latest weekly report from Arcane Research, the 7-day volatility of the cryptocurrency declined again this past week. The volatility is an indicator […]

The cryptocurrency and DeFi industries are known for their ongoing volatility. Sharp price drops and increases create opportunities to make money. Qilin goes one step further by providing active exposure to the price swings of any asset. Enhancing Volatility as A Tool The vast majority of cryptocurrencies are only known for their volatility. Although that […]

Volatility is currently what keeps many investors away from Bitcoin, and the situation is unlikely to change on its own very soon, as no central regulatory authority can or will be able to control any of its parameters. Bhandari confirms that “currently there is no way to profit off of Bitcoin’s volatility. You can buy an asset, but at this stage you have pretty much a 50/50 chance on whether it will go up or down.” Due to the fact that all investors can do with Bitcoin at present is invest for the long-term, Bitcoin options allow the community to “create strategies that profit off of....

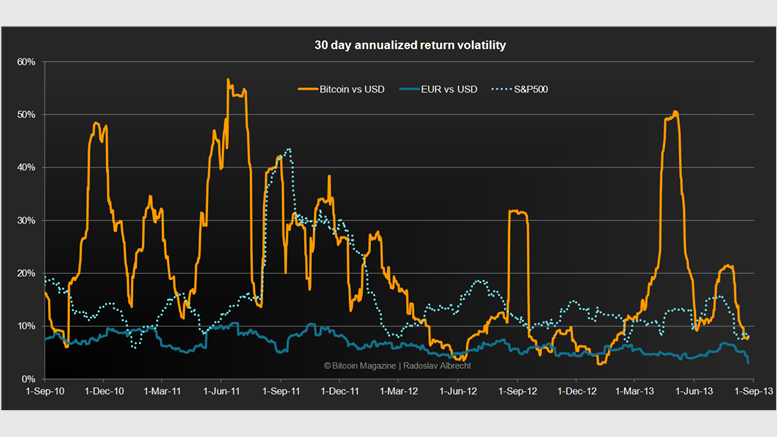

Since its birth in 2008, financial experts and institutional investors have criticized the viability of Bitcoin as an independent currency, due to its highly unstable volatility rate. According to data provided by the Bitcoin Volatility Index, however, the volatility of bitcoin price against major currencies such as US Dollars have declined significantly since 2010. More importantly, the rate of volatility has decreased at a consistent pace, dropping at an average rate of 25% per year. At the beginning of 2011, the standard deviation of daily returns (volatility rate) recorded around 8.5%.....

Data shows Bitcoin’s monthly volatility has been lesser than both Nasdaq and S&P 500 recently, here are their numbers compared. Bitcoin 30-Day Volatility Has Plunged Down To Just 1.4% In Recent Days As per the latest weekly report from Arcane Research, the US equities having a higher 30-day volatility than BTC has only happened twice […]