Bitcoin VC Investment This Year Already 30% Higher Than 2013's Total

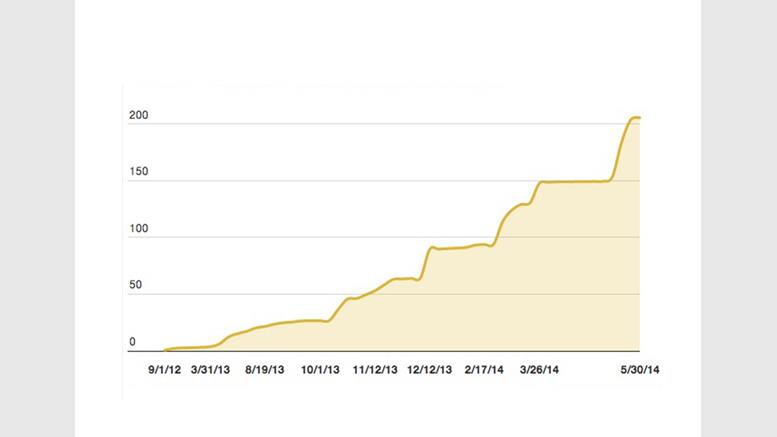

The amount of venture capital raised by bitcoin startups this year has already surpassed the total amount raised in 2013 by more than $27m. So far in 2014, $113.2m has flowed into bitcoin businesses, which is 29% greater than the total amount for last year, which stands at $88m. In 2012, bitcoin startups raised just $2.1m, according to CoinDesk statistics. The most active investor so far this year, by number of investments, was 500 Startups, which bought stakes in five companies. The Bitcoin Opportunity Fund, marquee venture capitalist Tim Draper and Crypto Currency Partners also made two....

Related News

Last year was a record year for Bitcoin when it came to venture capital investment, at almost $350 million in 2014. It looks like Bitcoin is approaching that amount already, and we're not even through the first quarter of 2015 year. Bitcoin startup 21 Inc. has announced that they have secured $116 million in venture capital investment, setting a record for not just a Bitcoin startup, but for any Bitcoin company in the technology's six-plus years. 21 Inc. looks to invest in Bitcoin "mass adoption." This company has been working diligently, and secretively, for over a year on securing this....

While the success of cryptocurrencies has been much highlighted in developed countries in 2013, 2014 is certainly the year when digital currencies will embrace emerging markets. One of the most important factors that indicate the growth of an industry is the amount of venture capital raised by its companies and startups. In 2013, Bitcoin startups raised a total amount of US$88m, which is 40.9% higher than 2012, as reported by CoinTelegraph. Last year, among the 5 biggest VC investments in Bitcoin startups, only one was a non-American company. In November, Chinese Bitcoin exchange BTC China....

Some good news for you Christmas Bitcoin lovers. Bitcoin just won the award "2013's Best Currency of the Year" by Global Post. This is awesome news and could give us a small boost in the positive direction. Hopefully we will win it next year as well. I personally believe that the year 2014 will be the biggest Cryptocurrency year yet to come. Now let's see :-). Here is an excerpt from Global Post: And the GlobalPost 2013 End of the Year Award for Best Currency goes to: Bitcoin. 2013 was the year that Bitcoin, a virtual currency traded anonymously via peer-to-peer exchanges, emerged from the....

As increased exposure hits bitcoin in the form of mainstream attention, the more interest in its business potential. As a result, 2013 was by far the biggest year for venture capital funding in the bitcoin space. And while some have proclaimed that next year will be even bigger, this past one has been pretty heady. Let's take a look at five of the biggest bitcoin venture capital deals of 2013. 5. itBit. Total VC to Date: $3.25m. Major Investors: Canaan Partners, RRE Ventures, Liberty City Ventures. Access to bitcoin in the form of an investment-grade trading platform still eludes the....

According to a new report, the SEC has launched a total of 97 actions against crypto players since 2013, 20 of which happened in 2021 alone. The Securities and Exchange Commission (SEC) has issued a total of approximately $2.35 billion in penalties against participants in the digital asset marketplace since 2013 according to a Jan 19 report by Cornerstone Research.The report, SEC Cryptocurrency Enforcement: 2021 Update, found that the SEC brought a total of 97 enforcement actions worth $2.35 billion between 2013 and the end of 2021. Fifty eight of the total of 97 were actions litigations....