Bitcoin Price Takes a Fall to Hit a Low of $300

The Bitstamp Price Index took a steep drop to hit a monthly low of $300.30, a figure struck near 03:00 UTC, November 11th. Yesterday, the price of bitcoin opened at $377.90 UTC to see a steady decline through the day before taking a steep fall at 20:00 UTC, from $352.40 to $332.07 at 22:00 UTC. The Bitstamp Price Index started 11/11 at $336.73 before dropping to a monthly low three hours later at $300.30. At the time of publishing, the Bitstamp Price Index was trading at $314.33. The price decline comes in the aftermath of the final Silk Road auction that saw the sale 44,341 BTC. Although....

Related News

Update: Today’s price low has been corrected from the earlier reported $887 to $885.41. After months of a sustained bullish rally, bitcoin price has swung to a significant slump, hitting a low of $885.41 on the Bitstamp Price Index (BPI) today. The dramatic drop comes within a day of bitcoin inching close to its all-time high. The first signs of a collapse began at 09:00 (UTC), when bitcoin was trading at $1,134.78. A thirty-minute trading period saw price fall quickly toward $1,068.84 before rebounding above the $1,100 mark an hour later. Come midday, things took a turn further south as....

Bitcoin was built and designed to be directly opposed to the dollar in every way. In a sense, it is its destiny to trade against the dollar until it meets its untimely demise. That demise could very well be beginning thanks to the pandemic, and its fall from glory could also fuel a future where Bitcoin takes its throne. Here’s what that could look like from a technical analysis perspective. DXY Dollar Currency Index Short-Term […]

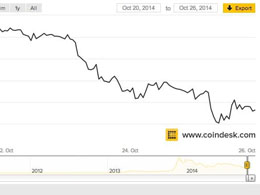

Bitcoin price resilience finally crumbled this week after two weeks of strength following the so-called 'BearWhale' slaying. The price opened the week at $386, holding steady until mid-week, when it began a steep decline. It closed at $346, shedding $40 over the last seven days. The bitcoin price deterioration follows a strong rally from $295 on 6th October to a high of $405 about a week later. Trading held steady until this week's drop, even as the wider financial markets tumbled in mid-October. Swaps activity spikes. A look at the swaps activity on Bitfinex reveals more bearish....

Ethereum price is continuing to fall. It is currently traded at the long-term correction peak. Is there a way for the price to go up? USDTETH. Fall in demand. The fact that Ethereum price could settle at $300 just confirms the upward trend is weak. This mark is important for growth since it was the point of the biggest offer. It wasn’t able to uphold, so obviously the supply surpassed the demand. But at the moment, the fall in demand seems to be temporary. Sharp upward impulses after sharp fall only prove that. According to Vitalik Buterin, the Ethereum network development influences the....

As the Bitcoin network replaces our current financial system and becomes the unit of account for the world, everything else will fall in price indefinitely.