Marqeta CEO: Blockchain Tech Isn't Just a 'Flash in the Pan'

“Bitcoin was a darling, now it’s the underlying blockchain.” That’s the perspective of the payments industry toward the distributed financial technologies space, according to Jason Gardner, CEO of payments-as-a-service provider Marqeta. The startup, which raised $25m in October, was one of the earlier payments firms in the space to experiment with digital currency, working with Ripple on a defunct debit card product that would have allowed users to spend cryptocurrency at traditional points of sale. Marqeta touts a cloud-based and API-driven processing platform for online and offline....

Related News

The company featured in the bestselling book "Flash Boys: A Wall Street Revolt" reportedly plans to use the blockchain to build a more transparent gold exchange. Startup TradeWind Markets, which recently spun off from The Investor's Exchange (IEX), is said to be preparing to launch the exchange in the coming months, according to Reuters. The firm aims to tap blockchain to increase the transparency of the gold exchange process, including the clearing and settling of trades. With the news, TradeWind Markets joins companies such as Netagio, itBit and Euroclear as the latest to....

The newest Wrapped Ether has an extensive list of improvements, including the anticipated flash mint feature. A team has released WETH10, the latest iteration of the Wrapped Ether token that allows using Ether (ETH) in a DeFi setting. WETH10 carries a host of useful features, the most notable of which is the flash mint, an evolution of the flash loan concept.Flash loans allow users to borrow the entire liquidity pool of a protocol to use as they see fit, without posting collateral. The only limitation is that the loan must be returned in full within the same transaction, otherwise the loan....

Blockchain project Origin Dollar (OUSD) has sustained an oracle manipulation attack. The attacker used flash loans to grab $3.25 million.

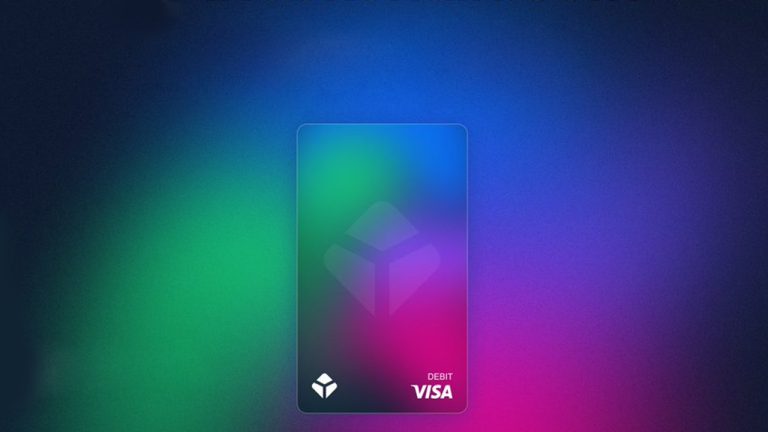

Crypto firm Blockchain.com has announced the launch of a new crypto-centric pre-paid Visa card and so far, 50,000 users have registered for the waitlist signup. In addition to launching its crypto Visa card powered by the card issuing platform Marqeta, Blockchain.com Visa users will earn 1% back in crypto whenever they spend funds using the card. Blockchain.com Introduces Crypto Visa Card Blockchain.com is joining the likes of Crypto.com, Ripio, Bitso, Coinbase, Bitpay, Blockfi, and FTX by announcing the launch of a new crypto-loadable pre-paid Visa card. According to the announcement on....

Binance Smart Chain (BSC) decentralized applications (dapps) have been hit with a number of flash loan attacks in recent weeks. According to collected data by Rekt, during the last 30 days BSC has lost a total of $167 million from these flash loan exploits. Flash Loan Hackers Prey on Binance Smart Chain Dapps – $167 Million Siphoned in May Flash loan attacks have become an issue for the Binance Smart Chain (BSC) as a myriad of BSC dapps were breached during the month of May. Essentially, these flash loans provide people with the ability to borrow crypto without relinquishing any....