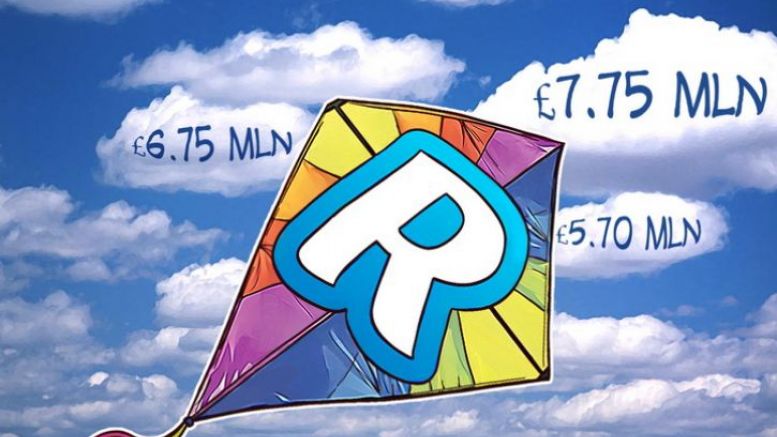

Fintech Startup Linked to Pre-Paid Master Card Raises Over £7.75 mln

UK-based fintech startup Revolut raised over £7.75 million of funding via venture capital firms. Equivalent to roughly $10,292,968 USD, £6.75 million alone was from 6 venture capital firms including Balderton Capital and Index Ventures with an additional £1 million raised by the company’s equity crowdfunding campaign on Crowdcube allowing users to get a slice of the company. Revolut itself is an app that is linked to a pre-paid MasterCard, giving the user all the features a MasterCard has and allowing people to deposit money using their bank account or credit card. Once loaded, users can....

Related News

Bringing the concept of borderless banking to mainstream consumers sounds like a proper use case for blockchain technology. But at the same time, a German FinTech startup is looking to provide exactly that service without using the blockchain. Number26 has quite the ambitious plan, although their service recently expanded to six additional European countries. As one would come to expect from a FinTech startup tackling the banking ecosystem, Number26 is focusing all of their attention on the mobile experience. As a result, customers can open a bank account – linked to a MasterCard – from....

Moneyfellows, an Egyptian fintech startup specializing in digitizing money circles, recently announced the close of its Series B funding round that raised $31 million. The funds will be used to finance Moneyfellows’ expansion into other markets as well as accelerate the fintech’s growth. Diversifying Moneyfellows’ Portfolio Egyptian fintech startup Moneyfellows recently revealed it had raised $31 million from its Series B funding round which was led by Commerz Ventures, Middle East Venture Partners (MEVP), and Arzan Venture Capital. Also participating in the round were....

Coinbase Ventures also joined the round.

A Tanzanian fintech startup revealed it has raised $10 million in its latest funding round and is planning to use the funds to finance an expansion into other African countries. Fintech Plans to Enter 12 More Countries by Year’s End The Tanzanian fintech behind an app that enables payments from the U.K. to Africa, Nala, recently revealed it raised $10 million in a funding round backed by Amplo, Accel, and Bessemer Partners. So-called angel investors that participated in this round include the founder of Robinhood, Vladimir Tenev, and Jonas Huckestein, CTO at Monzo. According to a....

Upgrade has announced their new bitcoin rewards card that offers unlimited 1.5% BTC back on every purchase paid.