Pantera Partner Steve Waterhouse Exits Bitcoin Investment Firm

Pantera Capital partner and chief technology officer Steven Waterhouse has departed the bitcoin and blockchain-focused venture capital firm. Founded in 2013, Pantera is one of the ecosystem’s largest VC firms, boasting a portfolio that includes some of its biggest success stories, including 21 Inc, Abra and Xapo. Waterhouse also served as a board advisor for bitcoin exchange Bitstamp and the now-defunct social tipping startup ChangeTip. A source close to the venture fund told CoinDesk that Waterhouse "wasn’t a fit" for the firm given its current ambitions, but did not disclose....

Related News

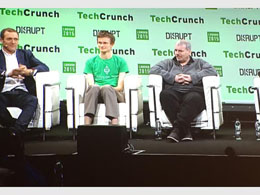

With blockchain technology enjoying buzzword status in mainstream finance and technology circles, it is hardly surprising that TechCrunch Disrupt London, held earlier this week, hosted a panel to discuss the potential of bitcoin and the blockchain. Led by TechCrunch editor and Freemit CEO John Biggs, the panel consisted of Ethereum founder Vitalik Buterin, Blockstream CEO Austin Hill and Steve Waterhouse, partner at the bitcoin investment firm and hedge fund Pantera Capital. The discussion, which touched upon various areas of debate, was first sparked by Biggs' questions about the....

Picking Chainlink over its competitors was an easy decision for Waterhouse. Decentralized VPN Orchid is adding a Chainlink oracle that, like a “secret shopper,” samples bandwidth pricing from all the providers in the network. Orchid co-founder Steven Waterhouse explained the importance of this feature, stating, “The basic idea is in decentralized services like Orchid, where we have a decentralized VPN, there's no way of really knowing exactly [how much a provider might charge]. A provider might say they’re charging a certain amount, we don't really know until you try it. So we wrote some....

P. Bart Stephens // Linkedin. Bitcoiners are ready to change the world. Anybody who has met one of the Bitcoin prophets has heard the spiel about how the legacy banking system is no good and it is time to revolutionize the system. P. Bart Stephens, managing partner of Blockchain Capital, has a more modest revolution in mind - getting rid of the spam in his e-mail's inbox. People with public facing email addresses know it all too well. A litany of spam e-mails can bombard an inbox, from penis enlargement, breast enlargement, money left for you in foreign banks, FBI, Treasury Department spam....

Investment firms Fortress Investment Group (FIG), Benchmark Capital and Ribbit Capital have teamed up with Pantera Capital to launch a bitcoin investment fund. The new fund will be known as Pantera Bitcoin Partners LLC and, as the name implies, it will be controlled by Pantera. Fortress, Ribbit Capital and Benchmark Capital will be minority equity partners. Fortress became the first Wall Street investment firm to enter the bitcoin space. Last year it was rumoured to be acquiring bitcoins and a regulatory filing published in February revealed it had set aside $20m for bitcoin investments in....

Fortress Investment Group LLC and Pantera Capital have announced that they are teaming up to form an investment fund focused on virtual currencies. According to the Wall Street Journal, the joint venture Pantera Bitcoin Partners LLC, is controlled by Pantera and allows minority equity partners Fortress, Benchmark Capital and Ribbit Capital to manage future and existing virtual currency-related investments through the fund. New York based Fortress, who manages about $58 billion in assets, was an early bitcoin investor. A recent regulatory filing indicates the firm purchased $20 million....