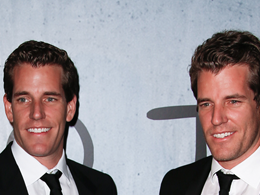

State Street to Serve as Winklevoss Bitcoin ETF Administrator

State Street has been tapped to help launch the first bitcoin exchange-traded fund (ETF). In a new SEC filing, State Street is now listed as the administrator and transfer agent for the Winklevoss Bitcoin Trust, a proposed bitcoin ETF backed by investors Cameron and Tyler Winklevoss, the founders of the Gemini bitcoin exchange. According to the filing, State Street would be responsible for the "day-to-day administration of the Trust" when it is launched, as well as maintaining its books of account and calculating the Trust’s net-asset value (NAV), or the value per share of the....

Related News

The SEC’s inefficient approval process of new ETFs has been criticized by a large group of financial experts and firms over the years. To ease barrier between the SEC and the Winklevoss Bitcoin Trust, the twins have made a few major alterations to its trading mechanisms and oversight. Partnership With State Street & Burr Pilger Mayer. Earlier this month, the Winklevoss twins have appointed State Street Corporation and Burr Pilger Mayer (BPM) to oversee its ETF. Specifically, State Street is operating as the ETF administrator, while BPM is in charge of all auditing processes. State....

Investment management firm State Street says that institutional clients are not deterred from investing in crypto assets despite price declines. “There is a belief that the asset class is here to stay,” a State Street executive said. State Street on Institutional Demand for Crypto State Street, a leading investment management firm, sees unwaning institutional demand for cryptocurrency despite market sell-offs, the Sydney Morning Herald reported Monday. Irfan Ahmad, State Street Digital’s product lead for the Asia-Pacific region, said the banking giant’s....

Gemini, the New York-based bitcoin exchange currently being developed by investors Cameron and Tyler Winklevoss, has received two key approvals from the New York State Department of Financial Services (NYDFS). Gemini Trust Company received approval on 23rd September for its Articles of Organization, and was granted an exemption from the deposit insurance requirements of Section 32 of the Banking Law, steps president Cameron Winklevoss said put it on the "one yard line" for completing its current goal of entering the US market. Cameron Winklevoss explained that, with its Articles of....

George Kikvadze, vice chairman of major Bitcoin mining and Blockchain technology company Bitfury, laid out his expectations and predictions for 2017 regarding the development of the Bitcoin industry, the community and, most importantly, the Bitcoin network. Highly anticipated events in Bitcoin industry. 2017 is a highly anticipated year for the Bitcoin industry, with companies like Gemini and SolidX approaching the approval process of their exchange-traded funds (ETFs). The Bitcoin ETF of the Winklevoss Twins, called the Winklevoss Bitcoin Trust, is particularly close to its approval and....

The exclusive United States specific bitcoin exchange, Gemini is one step closer to beginning its operations from New York. The company founded by Tyler and Cameron Winklevoss, better known as the Winklevoss Twins has filed the necessary paperwork with the New York State Department of Financial Services. According to Gemini's spokesperson, the Winklevoss twins are said to have completed the formality of filing the trust application with the government so that they can start operating as a trust company. A trust company, according to the definition of the State of New York is a financial....