London Startup Develops Blockchain-Based Contactless Payment Card for Retail Payments

London-based FinTech company SETL, Metro Bank, and global accounting firm Deloitte, have teamed up to develop a contactless card to enable faster transactions and settlement times for retail payments on the blockchain, in a recent announcement. In an initial test more than 100 people used the contactless smartcards to make purchases from shops that had the contactless terminals equipped. The test was part of the Financial Conduct Authority’s (FCA) FinTech sandbox that recently unveiled the 24 names of the companies taking part. The advantage of the technology means that it sidesteps any....

Related News

The payment world has evolved from cash transactions into a cashless ecosystem, as customers want to check out and pay for their goods with as little friction as possible. Contactless payments are on the rise in various countries, and in the United Kingdom, the average contactless payment transaction limit has been increased by 50%. Regardless of this change, additional infrastructure is required for merchants who want to make use of this system. In the United Kingdom, card payment terminals are a very common sight, as less consumers use cash payments year over year. From a convenience....

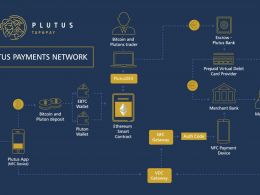

Plutus, a new start-up based in London, allows any merchant with contactless card terminals to accept bitcoin and ethereum payments regardless of whether the merchant has in fact adopted bitcoin or ethereum. Utilizing the new NFC technology, Plutus aims to make physical Bitcoin and Ethereum payments as easy as tap and go, with merchants not being aware the payment was a digital currency based transaction, ensuring almost universal acceptance of Bitcoin and Ethereum. The Plutus app, showcased in a video, converts Ethereum or Bitcoin on the fly, with the actual payment made in fiat.....

Spending Bitcoin is a critical part of making the digital currency a mainstream form of payment over the next few years. Up until this point, consumers had very little options to spend Bitcoin in physical locations, unless they own a Bitcoin debit card. That situation has come to change, now that mobile app Plutus lets people tap & pay with Bitcoin....

Curve, a financial services company based in London, has come out with a card and an accompanying mobile app that allows customers to scan all their debit and credit cards and then use each one for separate purchases with the one card. Single payment card. A Curve card can be obtained with a one-time payment of £35, after which, it’s free to use. In order to set up the card, users download the app and scan an unlimited number of bank cards, at which point, they will be synced to the Curve card. Despite this, the card works just like any other card, and doesn’t require a battery. “Curve....

London-based startup Plutus is developing a mobile app that will allow bitcoin payments at contactless payment terminals all over the world. The technology is powered by the Ethereum platform and is destined to work at all NFC-enabled payment terminals in the world, even if the merchant hasn’t enabled Bitcoin as a mode of payment. Plutus has announced a new application which will enable Bitcoin adopters to — in essence — pay with the cryptocurrency at NFC-enabled merchants all over the world. According to Plutus, the entire process works by the application converting bitcoin to fiat....