Bitcoin Derivatives Platform BTC.sx Debuts Language Localization Service for Traders in Asia, Europe, the Americas and Elsewhere

New service converts BTC.sx into Chinese (simplified and traditional), Spanish, Russian and Polish for global accessibility. The innovative Bitcoin company introduces its revised, dynamic website and new ratios of adjustable leverage: 5:1 and 2:1 options for traders with different risk profiles.

BTC.sx, the world’s first and exclusive platform for trading Bitcoin-only derivatives, announces the launch of its language localization service, which enables users to convert the BTC.sx site and features into Chinese (simplified and traditional), Spanish, Russian and Polish.

This service highlights the international popularity of BTC.sx, particularly in Asia, and follows a series of recent milestones such as the launch of a fully revised website for BTC.sx and the introduction of new ratios (5:1 and 2:1, from 10:1) of adjustable leverage for traders with different risk profiles.

In addition to these developments, BTC.sx will issue another important statement at the ‘Inside Bitcoins’ conference on 24-25 June 2014 in Hong Kong.

The recipient of an initial round of funding from Seedcoin, a virtual incubator for Bitcoin-related businesses, BTC.sx has a global profile and a noted reputation for transparency and ease-of-use.

By maximizing convenience – registration is fast and free – and with the freedom to choose the language of their choice, users have a secure method of transferring the monetary value of Bitcoin derivatives, between themselves and other people.

These new adjustable leverage ratios further reflect the worldwide appeal of BTC.sx. The 5:1 and 2:1 ratios allow traders with varied risk profiles and different objectives to go long or short on Bitcoin derivatives.

“Our language localization service is our response to the worldwide demand among traders for our customizable platform and suite of options,” says George Samman, Cofounder and COO of BTC.sx. “These strengths make BTC.sx the trusted resource for traders who appreciate our commitment to innovation and excellence.”

“Seedcoin applauds BTC.sx for having achieved yet another breakthrough,” said Eddy Travia, Cofounder and Chief Startup Officer of Seedcoin. “Since our investment in BTC.sx is also the most substantial stake, to date, by the Seedcoin Fund, we believe the language localization service is part of several competitive advantages that distinguish BTC.sx as the premier site for the trading of Bitcoin derivatives.”

About BTC.sx

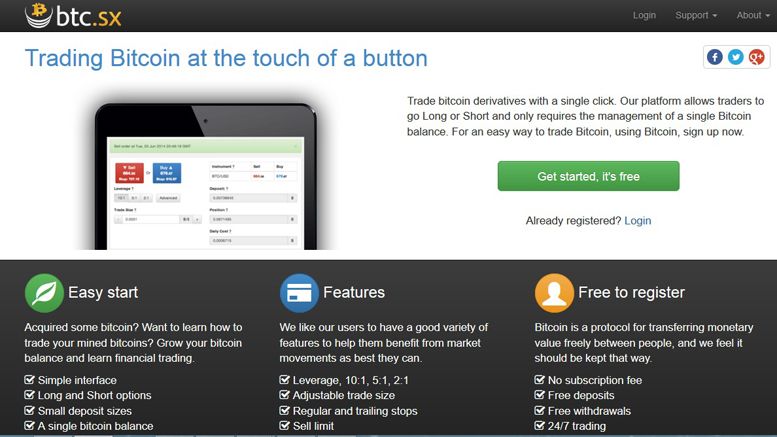

With offices in New York City, London and Singapore, BTC.sx has an innovative, intuitive and proprietary platform that allows users to easily trade Bitcoin derivatives. This flexible resource permits long and short positions, Bitcoin hedging (to prevent losses from a drop in the price of Bitcoin), automatic liquidation and stops for convenient position management, and without complex margin maintenance requirements.

For more information about BTC.sx, please visit http://btc.sx/

About Seedcoin

Seedcoin is the world’s first seed-stage Bitcoin startup virtual incubator, whose objective is to invest in the creative entrepreneurs of the cryptocurrency economy and help them develop the future services, products and applications re-shaping the way we interact with money on a daily basis.

For more information about Seedcoin, please visit http://www.seedco.in/

Related News

iOS & Android App Localization and Copywriting Company Babble-on, Introduces Bitcoin/Alipay Payments