President Bush’s Former US Director of Mint Offers a Fresh Option to Retirement with Bitcoin Investment

Bitcoin IRA is the first and only Bitcoin-based Individual Retirement Account in the United States. The digital currency company allows people to invest their conventional IRAs and 401(k)s in Bitcoin. Investing in Bitcoin as part of your retirement plan has been unheard of until now. A majority of the Bitcoin community has been using the digital currency mainly as a trade instrument. Other uses of Bitcoin so far have been as a medium of value transfer and short-term investments. Breaking the trend, Bitcoin IRA is now showing the community that long-term, profitable Bitcoin investments are....

Related News

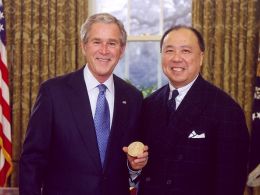

Bitcoin users can invest their Bitcoin in a fully compliant IRA retirement account through a new service announced today by BitcoinIRA.com. The Bitcoin IRA enables investors to hold Bitcoin directly as part of a tax-advantaged retirement portfolio. The company’s Chief Strategist is former director of the U.S. Mint Edmund C. Moy. ‘Lower Risk’ with Bitcoin....

If BitcoinIRA.com has its way, bitcoin will become ingrained as another retirement savings tool for generations to come. Edmund Moy, former Director of the U.S. Mint, serves as the group’s Chief Strategist…and possibly Chief Marketing Ploy. Many aspects of BitcoinIRA.com’s website lean heavily on Mr. Moy’s deep experience within the retirement savings space. The space and play are interesting within the context of the larger adoption of bitcoin as a serious and accessible digital currency. BitcoinIRA.com is certainly not the first group to offer bitcoin for investment. But serving the....

Ed Moy, a former U.S. Mint Director, has recommended cryptocurrency like bitcoin as one of three useful ways to diversify your personal portfolio, according to Newsmax’s finance section. As long as the Internet exists, digital currencies such as bitcoin will have value, and they are beyond the reach of government and banks at present. In addition to investing in digital currencies, he recommends hoarding cash and buying metal bullion coins. Moy, who served as the 38th Director of the U.S. Mint from 2006 to 2011, is a member of the advisory board of Virtual Mint, LLC, which creates....

On Monday, the San Francisco-based retirement plan provider for small to medium-sized businesses, Forusall, announced the launch of an alternative 401(k) plan that offers in-plan cryptocurrency access. According to the alt 401(k) investment option, Forusall is working with Coinbase Institutional as its retirement plan partner. Forusall and Coinbase’s Institutional Arm Offer Crypto-Infused Alt 401(k) Plan Forusall, the “one-click” retirement provider founded in 2012, has revealed that digital currency investors can now leverage the company’s alt 401(k) investment....

As bitcoin has gained attention as an asset, more people are considering it as an investment for retirement. The Bitcoin IRA came into being last year, a tool that can provide direct ownership in bitcoin. Jason Zweig, the author of The Wall Street Journal’s “The Intelligent Investor,” explored, in a recent article, using bitcoin as a retirement investment and concluded that people should be wary on account of the cryptocurrency’s volatility. Had someone invested $5,000 in bitcoin at the end of 2011, that amount would be worth just under $1.2 million earlier this month when bitcoin reached....