Billions In Bitcoin And Ethereum Leave Exchanges: Is Selling Pressure Easing?

A new trend is taking shape across the crypto market with investors pulling large amounts of Bitcoin and Ethereum from centralized exchanges. Data from on-chain analytics platform Sentora, formerly known as IntoTheBlock, shows that exchange balances for both leading cryptocurrencies have dropped notably over the past week. Prices are holding steady without much bullish momentum, but these massive withdrawals may hint at a subtle change in investor sentiment going into November. Related Reading: Dogecoin Flashback: Mirror Move Hints At Record-Breaking Surge Bitcoin And Ethereum Witness....

Related News

While the second-largest crypto asset by market cap has gained more than 15% in value against the U.S. dollar during the last week, the number of ethereum stored on exchanges has dropped significantly during the last few weeks. In less than two years, more than 29% of the ether held on exchanges has left centralized trading platforms and since December 2021, roughly 5.89% or 1.51 million ether has left exchanges. Number of Ethereum on Exchanges Continues to Drop Seven days ago, Bitcoin.com News reported on the number of bitcoin (BTC) held on exchanges and how the metric dropped to the....

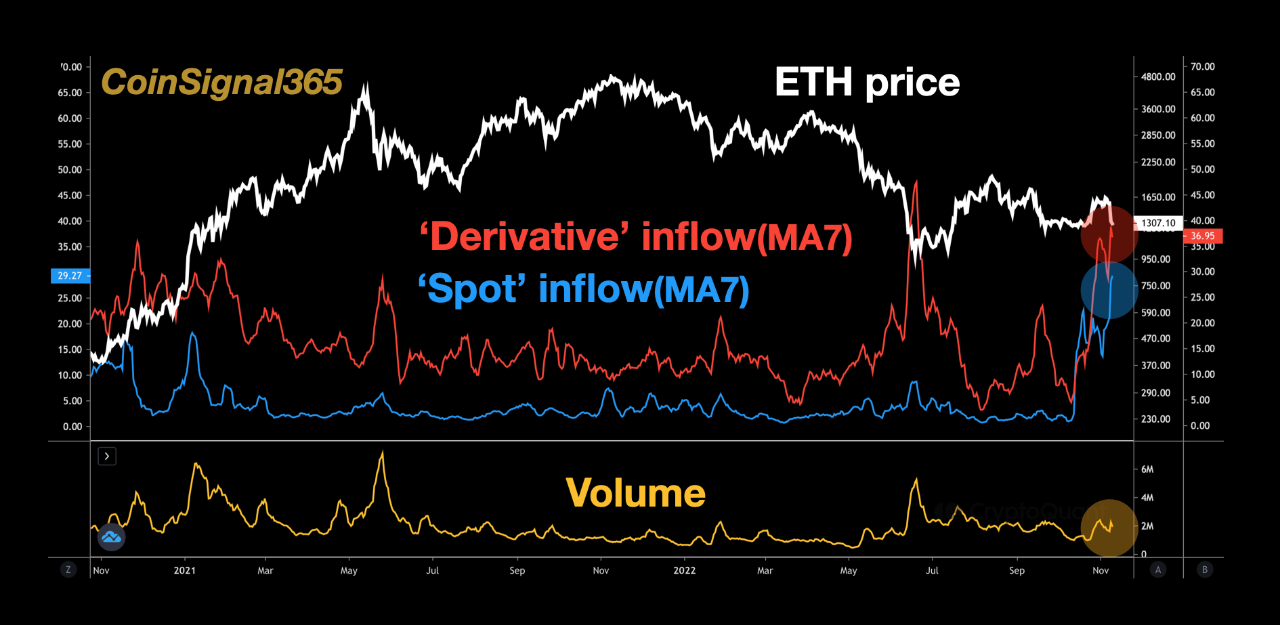

Ethereum has plunged below $1.3k today, but the decline may not be over quite just yet as on-chain data shows selling pressure continues to rise in the market. Ethereum Exchange Inflows Have Continued To Go Up During The Past Day As pointed out by an analyst in a CryptoQuant post, the ETH derivative and spot exchange inflows are both still on the rise. The “exchange inflow” is an indicator that measures the total amount of Ethereum entering into the wallets of centralized exchanges. There are two versions of this metric, the first notes the inflows specifically going to....

Ethereum has been struggling to break above $600 throughout the day, with the selling pressure proving significant. Each break above this level has caused it to see inflows of selling pressure that have slowed its growth and caused it to see slight rejections at this level. It is important to note that bulls are still […]

In the last 11 days, traders have withdrawn over 900K Ethereum (worth over $2.45B). Whales had also bought over 280K Ethereum ($756M) as of yesterday. What this means is less selling pressure and more price stability for the second-strongest cryptocurrency. $ETH is currently $2,700, a 2.4% increase in the last week, and community sentiment is […]

Ethereum has seen an intense selloff ever since its price reached highs of $1,450 just a few days ago The selling pressure here was rather intense and came about right as BTC started reversing its uptrend This caused the aggregated market to see some intense selling pressure that has yet to alleviate The crypto is […]