Why Impact Investing and Crypto Are Mutually Beneficial

Two of the fastest growing alternative investment classes – ESG and crypto – are mutually beneficial, says the CEO of Fasset.

Related News

Bitcoin enables mining utilities to engage in agreements that are mutually beneficial to miners and the electricity grid.

Former NFL player Derrick Morgan discusses impact investing, veganism and the long-term thinking of Bitcoin.

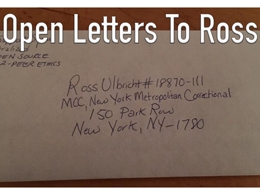

In this piece, the author gives a heartfelt exposition of Ross’ impact on libertarian circles and the market economy at large. I believe that this piece is truly powerful and sincere, and urge readers to submit their own letters to Ross; details for writing and sending a letter can be found at the end of this letter. Ross, The gift you left the world is....

The key difference between APY and APR is compound interest. Before investing, compare their potential returns. APR vs. APY: Which is better?The APY provides a clear idea of an account’s earning potential. The APR shows what will be owed. Both are calculated over a single year, which provides a more accurate picture than calculating the interest rate alone.Because the APR is calculated at an annual rate, it can be more advantageous for borrowers seeking the best rates, instead of investing in crypto assets and hoping for a return.However, because the APY is based on an annualized rate that....

The crypto bear market has had a significant impact on investing patterns across the space. Where the interest peaked in the bull market of 2021, the reverse was the case during the bear trend of 2022. In light of this, there has been an impact on the download numbers of crypto exchange apps across the […]