Bitcoin ETF may come to US, but not all crypto investors think it’s needed

As Bitcoin ETFs launch in Canada, an approval from U.S. authorities appears to be closer than ever before as naysayers start to run out of reasons to deny it. The United States Securities and Exchange Commission’s floor is littered with failed crypto fund filings, but this year, following Canada’s lead, the U.S. might actually have an exchange-traded fund that tracks digital assets. After all, the price of Bitcoin (BTC) is booming, the SEC has a new crypto-savvy chairman, and Canada, which is sometimes viewed as a beta test site by U.S. regulators, debuted a Bitcoin ETF in late February....

Related News

Often demonized for acting self-interestedly, activist investors can bring much needed focus to struggling organizations. In crypto, too.

With the market in turmoil, crypto investors are beginning to turn to stablecoins such as USDT and USDC to provide cover from losses. These stablecoins which are pegged to the U.S. dollar have been the obvious winners from the recent crash but it seems that investors are taking it one step further this time around. USDT volume across the Ethereum blockchain shows that investors are ramping up their activities in these stablecoins. USDT Provides Much-Needed Cover Through the crypto market downtrend, only a handful of cryptocurrencies have managed to retain their values. They were all....

A globally consistent crypto regulatory framework is urgently needed to allow banks to handle crypto assets on behalf of large customers, said a JPMorgan executive. “We need a globally consistent regulatory framework. It’s important that we get to a solution as quickly as possible.” Global Regulatory Framework Urgently Needed to Allow Banks to Offer Crypto Exposure to Clients, Says JPMorgan Debbie Toennies, managing director and head of Regulatory Affairs at global investment bank JPMorgan Chase & Co., talked about global cryptocurrency regulation applicable to banks....

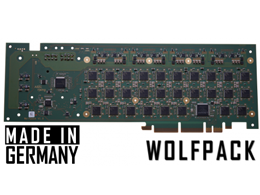

ASICRising, a German start-up is trying to find investors to produce a new high-performance microchip that it says would make bitcoin mining much cheaper and energy efficient. The process of mining is becoming increasingly expensive. While mining requires enormous amounts of energy to feed the computing power and cooling systems needed to get the hashing done, ASICRising happily says it has found a solution to this problem: an energy-efficient, low-voltage chip that together with specific software will reduce by more than half the energy needed to mine bitcoin.

Crypto is a “much-needed breath of fresh air” for those who believe that state solutions are often “inefficient, overpromise or underdeliver,” Brian Armstrong said. Brian Armstrong, co-founder and CEO of Nasdaq-listed cryptocurrency exchange Coinbase, took to Twitter to respond to a recent attack on crypto by Dogecoin (DOGE) co-creator Jackson Palmer.In a Twitter thread on Thursday, Armstrong pointed out some of the biggest benefits of cryptocurrencies like Bitcoin (BTC), stressing that crypto is “simply providing an alternative for people who want more freedom.”The CEO emphasized that....