Tradehill open to holding more auctions as it grapples with regulation

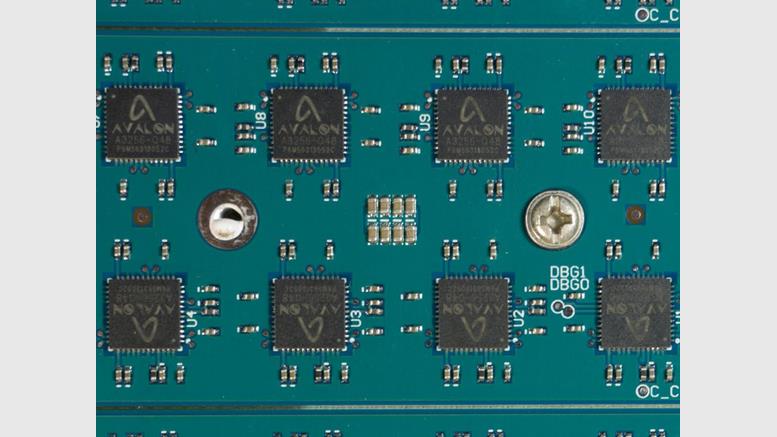

Bitcoin exchange Tradehill says that it may continue with its auction business after a successful first sale of Avalon ASIC miners. The firm operated an auction for ASIC mining company Avalon, in the midst of struggles to resolve its regulatory issues. This month, the San Francisco-based company conducted a two-week auction to sell Avalon's 60 Ghash/sec units. Tradehill founder and CEO Jered Kenna has left the door open for future business with other auction clients. "We can't say when the next one will be, but with the success of this one, there's no reason why we shouldn't do it again,"....

Related News

Although it was nowhere near the earliest in Bitcoin history, Tradehill was one of the largest exchanges in the Bitcoin economy when the currency had its first brush with public prominence in 2011. When the exchange first launched in June 2011, MtGox was by far the dominant player in the market, with a market share approaching 95%, and Bitcoin users were eager to see some competition. Following a marketing blitz over the next two weeks, attention on Tradehill increased rapidly, and the exchange was further helped along by a security breach at MtGox which caused the Bitcoin price to appear....

One day after customers reported receiving emails indicating that Bitcoin exchange Tradehill was closing shop for the second time in as many years, the trading service confirmed on its website that it had "temporarily suspended trading." Despite having publicly placed an emphasis on over-compliance with financial regulations in the United States, Tradehill now has a chance to break its own record as the only Bitcoin exchange to successfully reopen after a shutdown. Tradehill established that record in March of this year when it relaunched after an eleven month hibernation, distinguishing....

Tradehill's founder and CEO has confirmed the bitcoin exchange platform has suspended trading due to "operational and regulatory issues" faced by its bank - the Internet Archive Federal Credit Union (IAFCU). Jered Kenna said in a statement on reddit that trading on the Tradehill platform had stopped, but only temporarily. His statement reads: "We have recently made the decision to temporarily suspend trading on the Tradehill platform. Internet Archive Federal Credit Union has experienced operational and regulatory issues and we are no longer able to continue our relationship at this time.....

September 14th will be a big day for Jered Kenna. The former Marine knows a thing or two about hard sprints, which is exactly what he's facing this summer. Kenna is CEO of Tradehill, a bitcoin exchange focusing on high net worth individuals. Based in California, it calls itself the "single most secure and reliable major bitcoin exchange platform". It has never been hacked, it says. Indeed, the site, which launched on March 18th, hired tech staff from Google and Cloudflare (which specialises in mitigating DDoS attacks). When you're dealing with professional investors, you don't want to make....

A roller coaster ride as co-founder of Tradehill, an early Bitcoin exchange launched in 2011 that once rivaled now defunct exchange Mt. Gox, led Jered Kenna towards lifestyle brands. While working in bitcoin, things like regulation, banks and other associated headaches burned him out a bit on blockchain hype. On February 13, 2012, Tradehill announced it....