Chinese Bitcoin Ban Driven by Chinese Banking Crisis ?

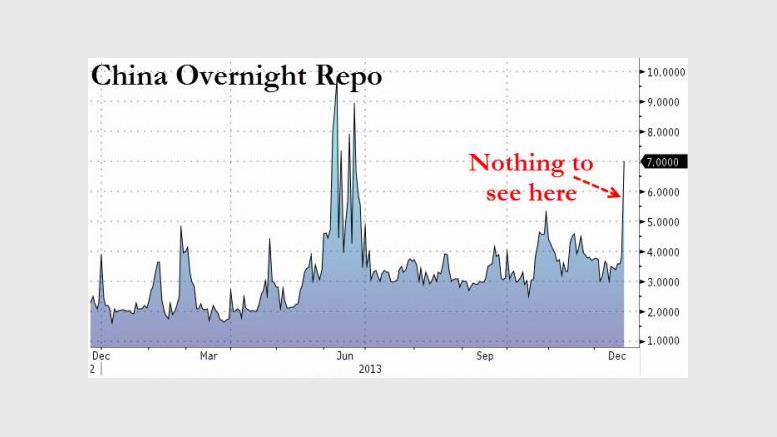

Recent reports from China indicate there may be more to the Bitcoin ban than meets the eye. According to the Financial Times (FT) the Chinese banking system is in crisis which could explain the Bitcoin ban in China. Chinese citizens seem to be running away from their own banking system in droves and their Government is closing the escape paths - including Bitcoin. During the run up of bitcoin in November you could watch the CNY currency leaking from China on sites like www.fiatleak.org and there was a breathtaking amount of Chinese currency leaking into BTC. The over night Repo rate is a....

Related News

The falling Chinese yuan has yet again led to a rise in the demand for Bitcoin among Chinese investors. Bitcoin price has picked up yet again. The price of the popular digital currency has crossed the $700 mark. Like always, even this time the increase in price is driven by rising demand among the Chinese investors. The latest developments in Bitcoin ecosystem is being closely watched not just by the cryptocurrency community, but also mainstream media and conventional financial institutions. Various leading news media outlets are reporting the surge in digital currency price, which is at....

BTC-e has opened up USD/CNH, BTC/CNH, and LTC/CNH markets today. Withlooming PBOC action that would end Chinese Bitcoin exchange's access to domestic bank accounts, Chinese traders are undoubtedly looking for new exchanges to trade on. Along with Chinese RMB (CNH to BTC-e) trading comes RMB deposits, which are handled through an international bank. An international bank means that Chinese traders wishing to convert fiat to crypto through this route will be subject to the Chinese $50,000 annual limit. In fact, people are starting to realize that the PBOC's still shrouded notice to regional....

The Coronavirus pandemic has driven people to take advantage of new business lines to deal with the economic crisis, and cryptocurrency is once again a headliner. Internet cafe owners in China are using their facilities to set up crypto mining farms after temporarily shutting down in 2020. Owners Are Earning Around $6,200 Monthly According to Sina, quoting a recently published report, almost 13,000 internet-fueled cafes that operate 24 hours a day, are depending on their high-end computers to mine digital assets, as their PCs were originally conditioned for gamers. Some of them claim to....

The banking- and finance-centric blockchain consortium led by New York-based startup R3 will now include its first ever Chinese member, the Ping An Financial Services Group. China’s second largest insurer, the Ping An Group has become the first Chinese member of the global banking blockchain consortium led by fintech startup R3. The R3-led blockchain effort was notable in its lack of Chinese members, until now. Ping An is the largest non-state-owned financial entity in China, with assets over $765 billion. The financial group has its footprint across different sectors including insurance,....

The private blockchain consortium led by blockchain technology startup R3 has added its newest member in China Merchants Bank, a Chinese banking giant. Guangdong-based China Merchants Bank (CMB), the first commercial bank wholly owned by corporate legal entities in China is now the second Chinese member to join the R3-led banking blockchain consortium. As of March 2016, CMB showed total assets of $838.28 billion and is among the top 10 banks in China and the top 30 banks globally, by assets. Elaborating on CMB’s new endeavor with R3, general manager of CMB’s IT department Tianhong Zhou....