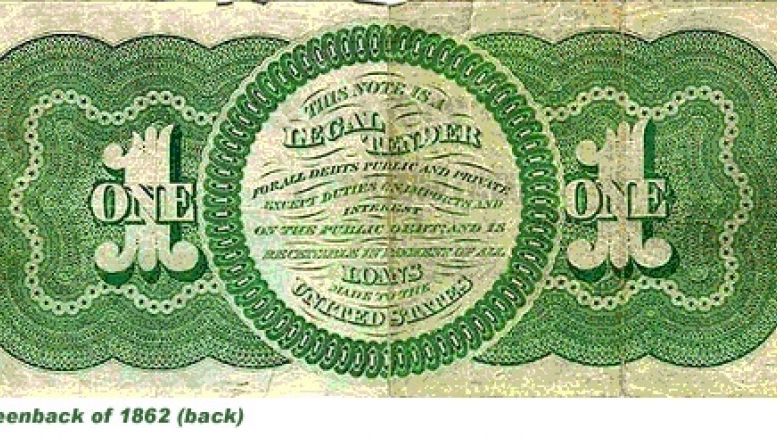

Greenbackers - The Wrong Approach to Bitcoin

The greatest accomplishment of Satoshi's technological advancement must be the ability to make huge power structures irrelevant. Making money and the financial system based in math and not in the whims of central authority is the most revolutionary change we may see in our time. However, there is a growing political thought that opposes the traditional monetary system for all the wrong reasons. Greenbackers are fiat money supporters that want to end the Federal Reserve and central banks in order to give the power of money to the government, allowing the state to print off money instead of....

Related News

It is impossible to deny the financial returns VC-backed companies can achieve in a few years. Companies who run an ICO in the Bitcoin world usually see far less returns, but the tokens are tradeable across exchanges. The Bitcoin and blockchain sector heavily relies on investments from VCs. But as it turns out, the venture capital approach can cause quite a few issues for companies as well. There is a right and wrong approach to dealing with VC funding when push comes to shove. Enterprises taking the wrong approach will find themselves at a significant disadvantage. In the end, it all....

The host of Mad Money, Jim Cramer, has apologized to investors for being wrong about Facebook parent Meta Platforms after its stock plunged to a record low. “I made a mistake here. I was wrong,” he said emotionally after stating previously that Meta was a good investment. “I failed to help people. And I own that.” Jim Cramer’s Apology About Meta: ‘I Was Wrong’ The host of CNBC’s Mad Money show, Jim Cramer, apologized to investors Thursday for recommending Facebook parent Meta Platforms Inc. (Nasdaq: META) after the stock kept tanking....

Ripple, which touts itself as the “Global Settlement Network” and has been involved with various banks to move money around the world, has its own ideas about how Blockchain can and can’t help the banking sector. Blockchain has been touted as the be all and end all solution for most if not all of the world’s problems. We have seen the application of Blockchain for everything from gift giving to releasing music. On the face of it, Blockchain appears to be the best possible solution for banking. Bitcoin has already demonstrated that it is possible to move money across the world quickly,....

Here's a look at what we are focusing on in the bitcoin price this morning. It’s Wednesday morning, and time to take a look at what’s going on with the bitcoin price ahead of the European open. We noted last night that things have been pretty unpredictable in the markets over the last couple of weeks, and that this has had two primary effects. The first, that we’ve had the opportunity to get in and out of the markets for a nice profit. The second, that in order to ensure we keep this profit net at the end of the week, we’ve had to be really tight with our risk profiles. This has – in turn....

Billionaire hedge fund manager Ray Dalio has admitted that he may be wrong about bitcoin after stating that governments will ban the cryptocurrency if it “becomes material.” Dalio founded Bridgewater Associates; his hedge fund is the largest in the world. Ray Dalio Open to Learning About Bitcoin Bridgewater Associates founder Ray Dalio has admitted that he may be wrong about bitcoin after stating last week that he did not think that cryptocurrencies “will succeed in the way people hope they would.” He further said that governments will outlaw bitcoin if it becomes....