Quebec Instills License Requirements for Digital Currency Businesses

One of the biggest stories in the news these past few weeks is the BitLicense. The second draft of the document is now available for view prior to its finalization following a 30-day period of commentary by the general public. As a result, all eyes have been watching New York, the document's official home. When it comes to cryptocurrency regulation, New York is probably first in line. As it turns out, the state's action may be inspiring other geographic areas to at least start following in its footsteps. In compliance with the Money-Services Businesses Act, the east-central province of....

Related News

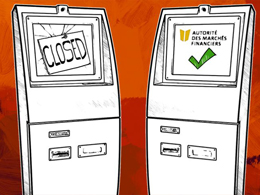

Businesses operating a digital currency automated teller machine (ATM) or an exchange platform in Quebec must obtain the appropriate license from the financial regulator, the Autorité des Marchés Financiers (AMF), in accordance to the Money-Services Businesses Act. The authority, which issued a public statement on Thursday February 12, said that companies involved in trading digital currencies, or which are operating a digital currency ATM, must hold the appropriate license and be authorized by the AMF, the regulatory and oversight body for Quebec's financial industry. The AMF further....

If you operate an exchange, bitcoin automated teller machine or any other money services operation that does business with Quebec residents, you will need to comply with its updated Money Services Businesses Act regardless of where in the world you are based. This new policy document was first made public on February 1, 2015 (updated to March 1, 2015), and experts have been trying to determine what it means for bitcoin businesses both within Quebec and outside its borders. The document says that anyone offering money services (that is, currency exchange; funds transfer; issue or redemption....

My name is Marco Santori. I'm a business attorney for technology companies. In particular, I represent digital currency businesses. I am also the Chairman of the Bitcoin Foundation's Regulatory Affairs Committee. In this multi-part series, I will give a basic primer on the state of US law as it applies to digital currency entrepreneurs. I aim to help bitcoin businesses assess their risks and develop an informed business model. In the first two parts of the series, we covered the law of money transmission on the federal and state-level in the United States. We learned that not all digital....

California may have a wealth of tech-savvy entrepreneurs anxious to create new businesses. But the state's lawmakers aren't doing them any favors as they move forward on a virtual currency license that saddles businesses with fees, paperwork and uncertainties. Businesses would have to pay a non-refundable fee of $5,000 just to apply for the license from the Commissioner of Business Oversight. Which makes one wonder about the bill's real intent. The Golden State's lawmakers aren't taking any time to study the ramifications of New York's recently-released Bitlicense before requiring their....

Houman B Shadab is a professor of law at New York Law School. Here, he discusses what itBit's recent banking law charter means for other digital currency exchanges operating in the US and beyond. Since their inception, bitcoin exchanges have operated under a fog of legal uncertainty. Just one day after the New York-based exchange itBit announced it had obtained a banking law charter giving it the ability to operate in all 50 states, a California official called that into question. Almost every state has its own licensing requirements for traditional money transmitters that include payment....