5 Revelations about Bitcoin from the ING 2015 Mobile Banking Survey

ING Bank hired global research firm, Ipsos, to survey 14,829 Internet users from 13 European countries, the United States and Australia. ING asked participants about mobile banking, payments and digital currency, such as bitcoin. The report has some sobering insights into how Bitcoin adoption is going in the West, including what consumers see as the....

Related News

Would you believe it if someone tells you that the most advanced countries in the world are the ones that adopt new technologies sooner than the rest? If you did, then you might be wrong with a few things, especially mobile banking and Bitcoin adoption. Let's take Turkey for example. ING, the Dutch multinational banking and financial services company recently published a report titled "ING International Survey - The rise of mobile banking and the changing face of payments in the digital age" . The survey was conducted by ING along with Ipsos to understand the behavior of its existing and....

Over the last couple of years, there have been many surveys done about what Bitcoin is and what people think of Bitcoin. The Digital Currency Council (DCC) and Coin Report have done surveys to get consumer opinion on its progress. As Bitcoin has grown, so have the corporate players involved, and the number of countries using Bitcoin worldwide. Now, financial giant ING has integrated Bitcoin into a massive mobile banking survey that covered most of Europe, with over 12,400 people responding to questions about Bitcoin, and it's future in the mobile user space. Bitcoin Survey: The countries....

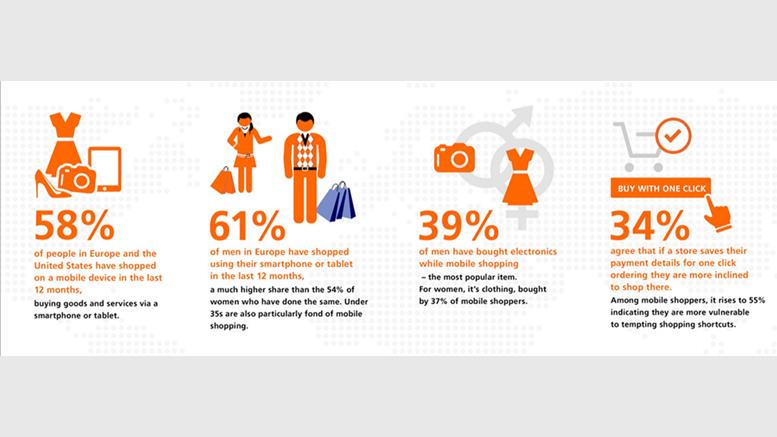

Mobile Economy is the "in-thing " now. The number of users using their mobile phones to make transactions and buy good and services is increasing day by day. Mobile money as we know it involves Mobile banking, M-commerce and wallet services. The rise of mobile payments in recent days has got people referring 2015 as the Year of Mobile Payments. We have seen drastic improvements in the way transactions happen. People are increasingly switching from physical and web based digital banking from their desktops to mobile phones. It should come as a surprise, as most of the smartphones available....

The Commercial Bank of Dubai (CBD) is getting ready to launch a mobile app-based digital bank for its clients in a bid to change the relationship between the bank and its customers, according to a report from Computer Weekly. Expected to launch early next year, the digital bank will be known as CBD NOW, which is intended to target Millennials, the generation of people who tend to carry out their day-to-day activities via their phones. According to a British Banking Association [PDF] report, in 2015 there were 11 million logins to banking apps each day compared to 4.3 million logins to....

As of May 2016, a total of 3.7 million mobile transactions were recorded since the launch nearly two years prior. Even though there has been a significant increase in mobile device usage among residents of India, mobile banking will not be coming anytime soon. The country has plans to improve financial inclusion through a new set of mobile banking services. Unfortunately for them, that project failed miserably. This leaves the door wide open for Bitcoin adoption in the country, as cryptocurrency allows anyone to be their own bank. Mobile Banking In India Is Not A Success. It has to be....