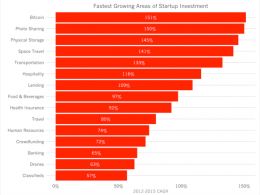

Tomasz Tunguz: Bitcoin Is the Fastest Growing Area of Startup Investment

Tomasz Tunguz, a partner at venture capital firm Redpoint, has written a post titled "The Fastest Growing Areas of Startup Investment in 2015" on his personal blog. "Which lesser known startup sectors are starting to raise venture dollars?" asks Tunguz. "Where are founders finding unique opportunities to innovate?" The answer: Bitcoin is the fastest....

Related News

Bitcoin is the fastest growing area of startup investment since mid-2012, a venture capitalist at Redpoint has claimed. In his recent analysis of Mattermark data, Tomasz Tunguz noted that investment in bitcoin companies - closely followed by photo sharing and physical storage startups - has grown by 151% in the last three years. Image via Tomas Tunguz. However, Tunguz pointed out that bitcoin startups represent a

Jason Fung, the former head of TikTok gaming, exited the fastest-growing social media platform. After his exit, the ex-executive rolled out his new startup on Blockchain gaming. Through his announcement on July 5, Fung stated that he exited TikTok to facilitate the launch of MetaO. He explained that MetaO is a startup that focuses on […]

This week, ABEY has announced that it has been adding an average of 20,000 active ABEY 2.0 addresses each week since the beginning of August 2021, making it one of the fastest-growing blockchains in the world and finishing an exceptional week that included the ABEY token being listed on Liquid Global, a premier international cryptocurrency exchange. ABEY developers say there are more than 120,000 active ABEY 2.0 addresses today, quadrupling from 30,000 addresses at the beginning of August. Developers say this growth began around the first airdrop of XT, the native token of XSWAP on August....

Blockchain games are one of the fastest-growing segments of the gaming industry. In the first quarter of 2021, the startups that are developing blockchain games have attracted $476 million which is double the size of the investment during 2020. Furthermore, during the third quarter of 2021, from July to September, the investment volume exceeded the […]

Bangalore-based startup UnoCoin has raised an impressive $1.5 million in a pre-series A funding round. Bangalore-based startup UnoCoin has raised an impressive $1.5 million in a pre-series A funding round, the largest sum ever comprised for a digital currency company in India’s history. Among the investors were Blume Ventures, Mumbai Angels, Bank to the Future, Bitcoin Capital, FundersClub, and Digital Currency Group and Boost VC, headed by Barry Silbert and Adam Draper respectively. Expressing his enthusiasm, Silbert believes the company will do great things in the future: “Since making....