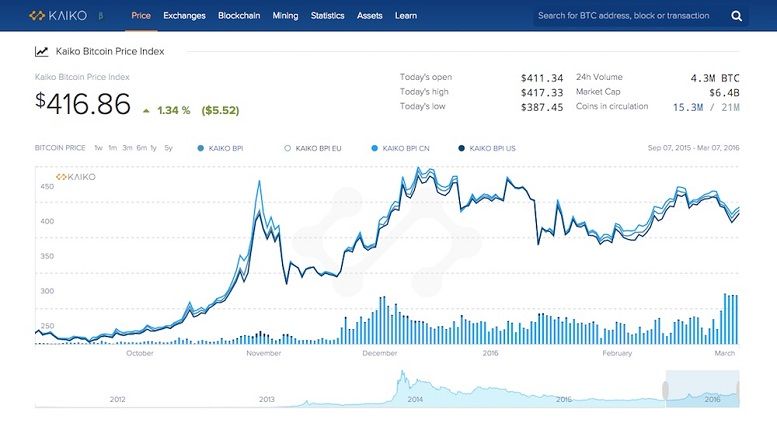

Kaiko: New Price Indices for a Global Bitcoin Market

What is one bitcoin worth, right now? Unfortunately there's no easy answer to that question. Prices can sometimes differ wildly across the various exchanges worldwide – mainly due to the lack of liquidity and market efficiency in the bitcoin world.

We're solving this problem with the Kaiko Bitcoin Price Indices. They’re first of a kind: transparent, replicable, and truly global.

Even better, you’re free to incorporate this data into your own bitcoin site/service right now. Our Live APIs are available to use for free. There’s even an attractive, ready-made price widget for download from GitHub.

The problem we’re solving with bitcoin prices

In ‘regular’ international foreign exchange markets, spreads between major currencies like dollars, euro, yen are extremely thin because of the relative easiness of arbitrage. Moving fiat currencies from one bitcoin exchange to another can take a while, and can be costly – so the spreads are larger in bitcoin forex.

Even though bitcoin price difference is usually under 1%, it can grow to a few percentage points – say, if one exchange is ‘pumped’ faster than others, or an exchange suffers technical or regulatory difficulties. As such, we’ve seen in the past few months that Chinese trading action has driven overall market activity.

Kaiko’s main BPI is a standard, worldwide bitcoin spot rate based on exchange data from all major trading regions, including China. It sits alongside our other currency-based indices – the Kaiko USD Bitcoin Price Index, Kaiko EUR Bitcoin Price Index and Kaiko CNY Bitcoin Price Index.

What makes Kaiko's index better than others?

We publish a global index that is based on the trading data against all currencies from the top exchanges in various countries.

This isn't the first time someone has tried to create a unified index price for bitcoin. But it's the best one yet, and the first multi-currency price index to take into account all exchanges including Chinese exchanges in a relevant manner. We're acknowledging that bitcoin is international; that much of the volume and liquidity are located in China.

What’s more, the Kaiko Bitcoin Price Indices are the only indices we know that include actual liquidity of each exchange – by focusing on order book depth to correct for artificial volume increase, due to zero trading fees on some exchanges.

Large spreads between exchanges

Whether they’re due to friction with banks, systemic risk, poor arbitrage or an exchange experiencing difficulties, large spreads are a pain:

Ordinary bitcoin users and investors have no accurate guide as to how much their holdings are really worth.

For merchants, it's hard to convert local currency prices properly.

For those based in jurisdictions where bitcoin value is monitored for tax purposes, it's hard to calculate capital gains.

It is also very hard to price, buy and sell derivatives and hedge yourself without a robust underlying price index.

Kaiko’s computation methodology

The Kaiko BPIs are built to be transparent and easily replicable, computing prices for which you can actually acquire bitcoins. It uses historical trade and orderbook data from all major exchanges stored in our database.

Our engineering team has realized that, in bitcoin, calculating from volumes traded on each exchange is not enough – and can lead to misinterpretation of the actual bitcoin price. An index using such a methodology would be limited in two ways:

Exchanges that experience a high volume crash or spike don't necessarily represent the rest of the market.

Exchanges that artificially increase their volume, but don't have correspondingly high liquidity, can appear healthier than warranted.

With such a simplistic approach, the price you see would never be the price you’d eventually get.

Liquidity and trading volumes

To solve this issue, we use order book depth as a liquidity proxy. The more liquid the exchange, the more bitcoins you can trade on it without impacting the price – and therefore the less expensive it is to trade on it. This liquidity measure is combined with trading volume data to reflect something much closer to the price you’d actually pay.

Based on the current structure of the bitcoin market, we decided to give liquidity twice as much importance in the weighting process. Kaiko indices are based on all major exchanges, are easy to replicate, and perfectly reflect what bitcoin is worth.

Finally, Kaiko’s engineers have made every effort to rank exchanges in real-time. In addition to the different price indices, Kaiko offers to identify the most active markets : those which drive the price as opposed to other markets which are merely followers. Those are determined by analysing the correlation between the buy/sell pressure and the price trend.

We constantly identify which exchange is 'leading' the current worldwide price, and which exchanges are 'followers'. Like the indices themselves, this is constantly updated.

Price Index Advisory Board

Kaiko will also shortly announce members of its official Advisory Board, which will assist the company in maintaining a professional-standard price index.

You can read all the details of Kaiko’s current index methodology here. While you're on the site, check out the other essential bitcoin statistics and background information we have to offer. Again, feel free to use our live APIs to give greater accuracy to your bitcoin site or service.

Users are now armed with a lot more knowledge about bitcoin and – more importantly – exactly what it's worth. Everywhere. All the time.

Kaiko: New Price Indices for a Global Bitcoin Market

https://kaiko.com/bitcoin-price/

Related News