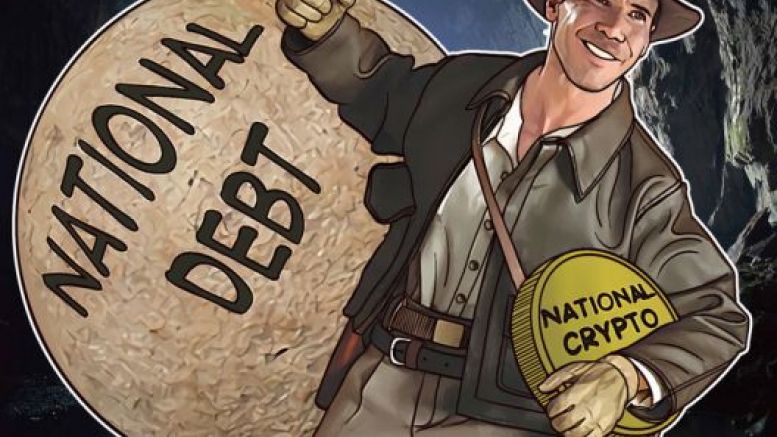

National Cryptoequity - Pleasant Opposite of National Debt?

The modern government-run financial system employs a staggering amount of national debt. The United States’s national debt is fast approaching $18 trillion, with no sign of stopping. This debt, while incurred by the government, ends up being the responsibility of the public to pay it off, or else risk collective financial suicide. However, instead of shouldering this massive burden and having economic progress crushed under its weight, there exists a way to use cryptocurrency to achieve the opposite effect for people: give them equity. Currency control stifles business and innovation.....

Related News

The latest grim milestone for the U.S. economy means that its national debt total is now 4,000% larger than the Bitcoin market cap. The United States’ national debt has passed $30 trillion — and even all the Bitcoin (BTC) in the world would hardly touch it.According to the latest official statistics, U.S. national debt is at levels never seen before, passing the psychological $30-trillion barrier for the first time this week.Bitcoin is worth less than 3% of U.S. national debtAfter two years of liquidity injections fuelled by issuing even more debt, the Federal Reserve is attempting to rein....

US President Donald Trump recently stated that cryptocurrencies could be used to alleviate the ballooning US national debt, which has recently exceeded $38 trillion. Trump’s statement has triggered a global conversation about the role of digital assets, especially Bitcoin (BTC), in addressing the US’s debt crisis. Can Bitcoin Be Used To Clear The US’ National […]

The US national debt is several times greater than the value of all physical cash, and thousands of times the value of Bitcoin. Standing at around $19.5 trillion, the debt accrued by the US federal government amounts to significantly more than the combined value of all the world’s physical cash, gold, silver, and cryptocurrency. Those four combined barely cover two-thirds of the US national debt, leaving the daunting task of debt reduction. Bitcoin is still a small player in the global financial world. Besides the staggering level of US debt, what this fact reveals is how new and minor a....

A crypto commentator is once again discussing how the United States may use XRP in a key plan. According to his post, XRP could one day reach very high prices and still be small compared to the US national debt. He suggests crypto could one day help solve the country’s money problems and tells people to hold four digital assets that he believes are important for the future. He says he has known about these ideas for a long time and is reminding the public again. Crypto Pundit Says XRP At $1,000 Is “Peanuts” For US National Debt The crypto commentator, known as The Real Remi Relief on....

A recently published forecast stemming from the Federal Reserve Bank of Cleveland’s Inflation Nowcasting data indicates upcoming U.S. consumer price index (CPI) metrics will likely be elevated. The newly predicted CPI levels were recorded the same day America’s gross national debt surpassed $31 trillion on October 4, as the country’s growing debt continues to rise rapidly. Fed’s Nowcasting Report Shows Inflation May Not Have Peaked, Data Predicts September and October Core CPI to Jump 0.5% The U.S. central bank may not be too keen on slowing down rate hikes if....