Bitcoin Price Passes $420 Mark Amid Institutional Attention

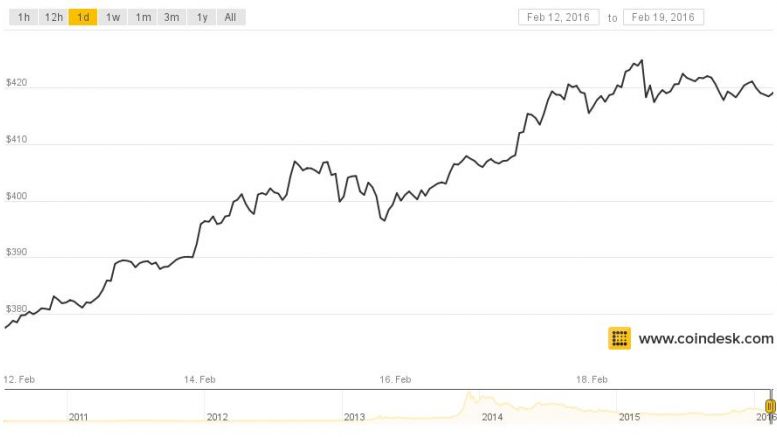

Markets Weekly is a weekly column analyzing price movements in the global digital currency markets, and the technology's use case as an asset class. Bitcoin prices rose over the last week, pushing higher as the sentiment surrounding the digital currency strengthened. Bitcoin was trading at $421.69 at 12:00am (UTC) on 19th February, compared to $377.82 on 12th February at 12:00am (UTC), according to the CoinDesk USD Bitcoin Price Index (BPI). This increase represents a gain of more than 10%. This week provided a contrast to the prior seven-day period between 4th February and 11th February,....

Related News

Despite the ongoing wave of bearish price action for Cardano (ADA), the token appears to be attracting a notable amount of adoption and attention. Large capital is currently being moved in the leading network and altcoin, particularly from institutional players. Are Institutions Betting Big On Cardano? Lately, Cardano is experiencing a fresh influx of capital […]

The XRP price saw a rapid increase alongside the rest of the crypto market over the weekend, bringing its price finally above the $0.53 mark. Amid this increase in price has emerged a pattern that suggests what might be going on with the altcoin. Real Volume Amid XRP Price Rally In the real volume chart […]

The price of the meme-based cryptocurrency is at an all-time high as it approaches $0.20. The price of Dogecoin has surged seemingly without any push from prominent figures on social media or major developments in the project. According to data from CoinMarketCap, the price of Dogecoin (DOGE) is more than $0.18 at time of publication, with a market capitalization of roughly $23.8 billion. The token’s most recent rally had its price surge more than 63% over the last 24 hours, passing both Uniswap (UNI) and Litecoin (LTC) and become the 8th largest cryptocurrency by market cap. More retail....

Bitcoin (BTC) recently surged past the $110,000 mark, supported by growing institutional backing and the launch of spot Bitcoin ETFs. This comes in after a week of volatility that has seen BTC go below support levels. Related Reading: Ripple CTO Schwartz Revisits NSA Past And Satoshi Speculation However, despite the bullish momentum, Tom Lee, chairman […]

The CME has become the largest bitcoin futures exchange by open interest amid institutional onboarding.