Bitcoin miners selling stock and BTC as returns halve since November

Miners are starting to get strapped for cash and need a boost since BTC has dropped in price since November and revenue has fallen even further due to increased competition. Bitcoin miners are selling off coins from their stockpiles and shares in their companies after the profitability of mining took a dive since November.With Bitcoin (BTC) currently holding around $43,500, about 33% below the all-time high (ATH) of about $69,000 reached that month, miners are selling at a less-than-opportune time. However, electricity and equipment bills must be paid.Data from on-chain analytics firm....

Related News

The upcoming record difficulty drop means mining Bitcoin is about to get a lot more profitable while hash rate slowly returns to the network, Glassnode predicts. Bitcoin (BTC) miners are “unlikely” to pressure BTC price by selling coins in the coming weeks, new data says.As part of its latest weekly report, The Week On-chain, analytics resource Glassnode sought to allay fears of another large miner sell-off.Difficulty drop a gift to remaining minersAmid the ongoing transfer of mining equipment — and therefore Bitcoin hash rate — out of China, fears have emerged over miners selling BTC to....

Selling pressure had been mounting on public bitcoin miners over the last couple of months. This was a direct result of the decline in the price of the digital asset, which saw the cash flow for bitcoin miners plummet significantly. It came out to an over 60% decline in profitability, and given that miners continue […]

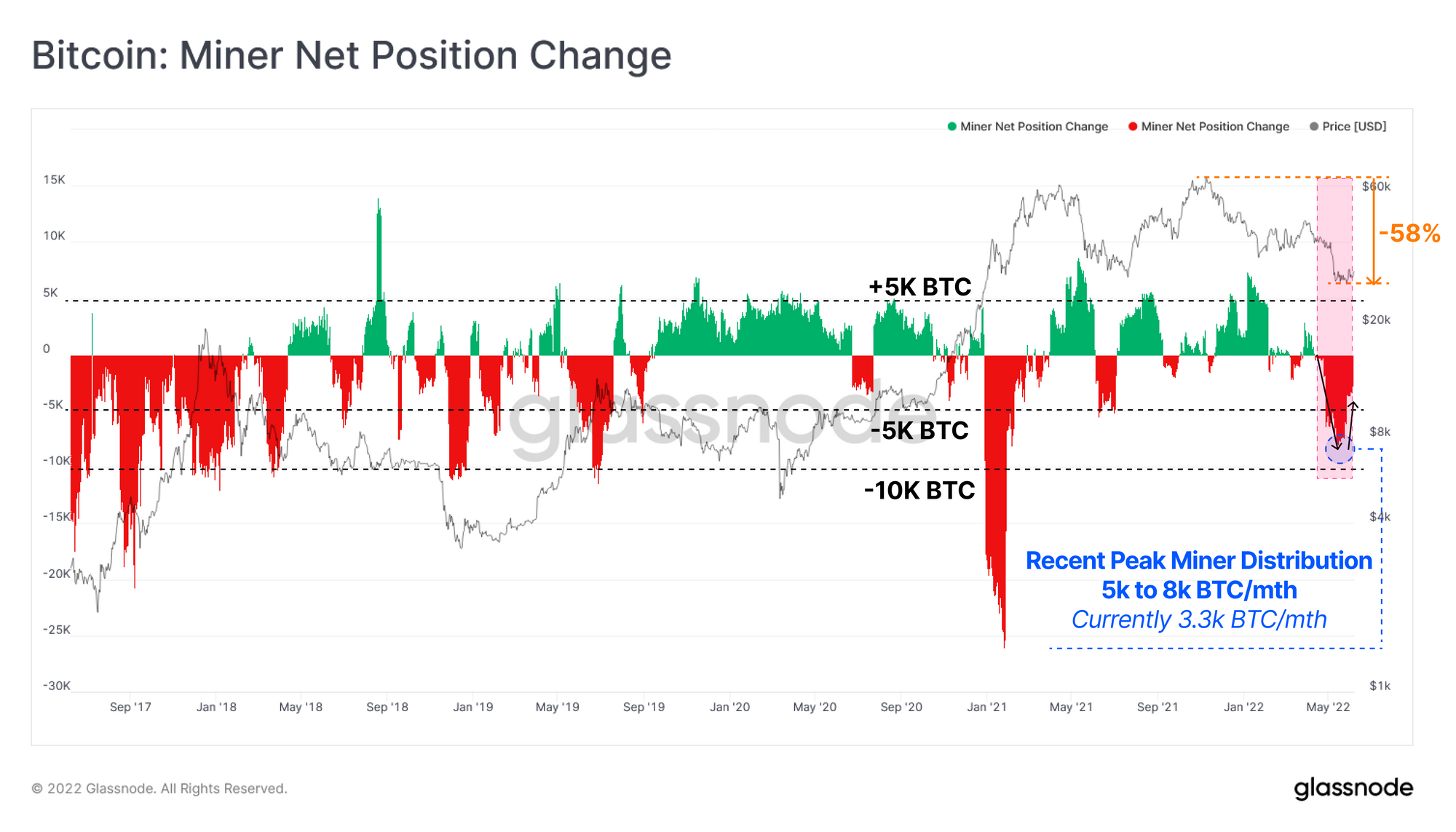

Data shows Bitcoin miners have been selling in recent weeks as their revenues have come under stress due to the struggling price of the crypto. Bitcoin Miners Are Currently Selling An Average Of 3.3k BTC Per Month As per the latest weekly report from Glassnode, miners had been accumulating during the initial drawdown from the […]

Microstrategy Inc. is selling up to $1 billion of its common stock, MSTR, with the aim to use some of the net proceeds to buy bitcoin. The Nasdaq-listed company also recently completed a $500 million secured notes offering and will use the proceeds to acquire bitcoins. Selling MSTR Stock to Buy Bitcoin Microstrategy Inc. has filed a registration statement with the U.S. Securities and Exchange Commission (SEC) to launch an “‘at the market’ securities offering for flexibility to sell up to $1 billion of its class A common stock over time,” the company announced....

Yet another bitcoin stock exchange is about to bite the dust. BitFunder has announced it is closing down. The site, which launched in December 2012 and held around $16m in assets in July, will cease trading on 14th November and transfer out any leftover bitcoins held by users on 2nd December. BitFunder owner Ukyo, aka Jon Montroll, made the announcement in a post on the BitFunder website and on the Bitcoin Talk forum, saying: "As of November 14, 2013, no BitFunder user will be able to enter into any new positions or sell positions on the BitFunder website. "... As of the date of this....