Better days ahead with crypto deleveraging coming to an end: JPMorgan

A strategist at JPMorgan predicts that the worst of the bear market could be over as stronger crypto firms have come in to bail out the industry in the midst of major deleveraging. The historic deleveraging of the cryptocurrency market could be coming to an end, which could signal the close of the worst of the bear market, according to a JPMorgan analyst.In a Wednesday note, JPMorgan strategist Nikolaos Panigirtzoglou highlighted increased willingness of firms to bail out companies, and a healthy pace of venture capital funding in May and June as the basis for his optimism. He said key....

Related News

Global investment bank JPMorgan has warned of the crypto market facing weeks of deleveraging stemming from the crisis at Sam Bankman-Fried’s crypto exchange FTX.com and trading platform Alameda Research. The firm’s analysts also predicted that the price of bitcoin could fall to $13,000.

JPMorgan on FTX and Bitcoin’s Price

JPMorgan Chase’s analysts, led by global market strategist Nikolaos Panigirtzoglou, provided their analysis of the FTX situation and a price prediction for bitcoin in a note Thursday.

The analysts explained that fewer....

Analysts at JPMorgan now assert that optimism among individual investors in cryptocurrencies is on the rise, with a brighter market forecast following extreme downturns. JPMorgan revealed in a research released on Friday that it expects retail demand for cryptocurrencies to increase. The bank added that the severe phase of deleveraging brought on by falling digital […]

The last six weeks have been among the worst in bitcoin’s history. Despite only being in existence for just 12 years, the world’s most valuable digital currency has had its fair share of gloomy days and price swings. However, according to a new report from financial giant JPMorgan, bitcoin’s price, which has been plummeting in […]

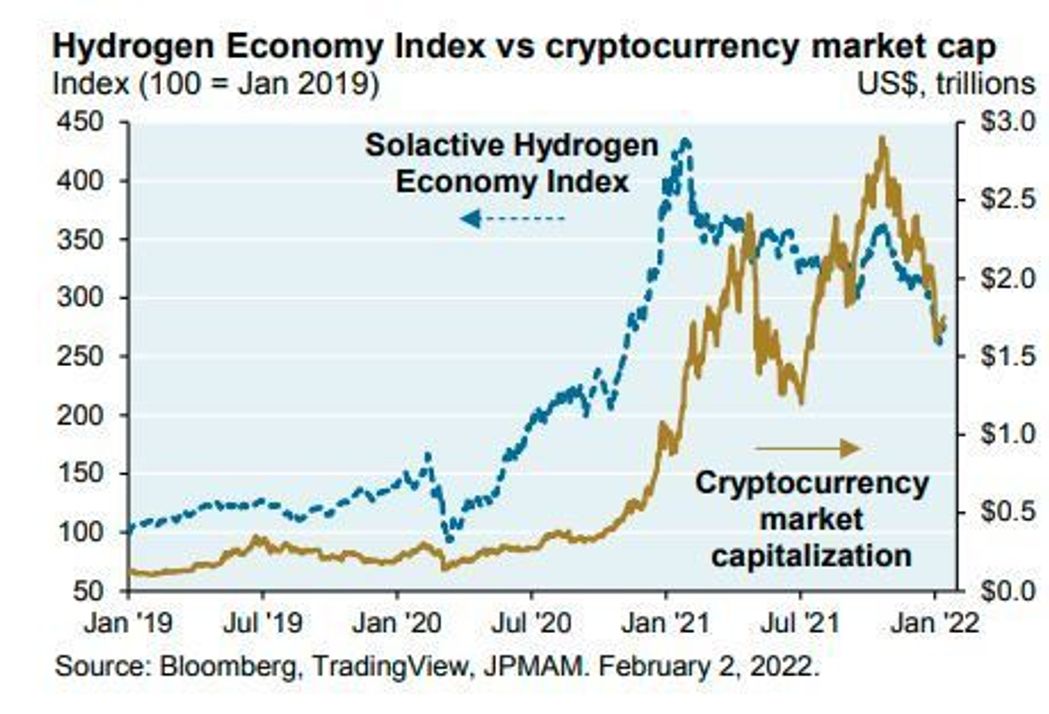

JPMorgan’s chairman of investment strategy, Michael Cembalest, is wary of bitcoin and other cryptocurrencies. The JPMorgan strategist stated in a column published Feb. 3 that his comments were his own and not those of JPMorgan Chase. JPMorgan Strategist Raises Issues With Crypto Market While much of the United States recovers from last week’s terrible winter […]

Global Investment bank JPMorgan says, “The metaverse will likely infiltrate every sector in some way in the coming years, with the market opportunity estimated at over $1 trillion in yearly revenues.” The firm has set up a lounge in Decentraland.

JPMorgan on the Metaverse

Global Investment bank JPMorgan recently published a report titled “Opportunities in the metaverse.” The report is authored by Christine Moy and Adit Gadgil. Moy is the global head of Liink, Crypto & the Metaverse at Onyx by J.P. Morgan. Gadgil is the head of e-commerce....