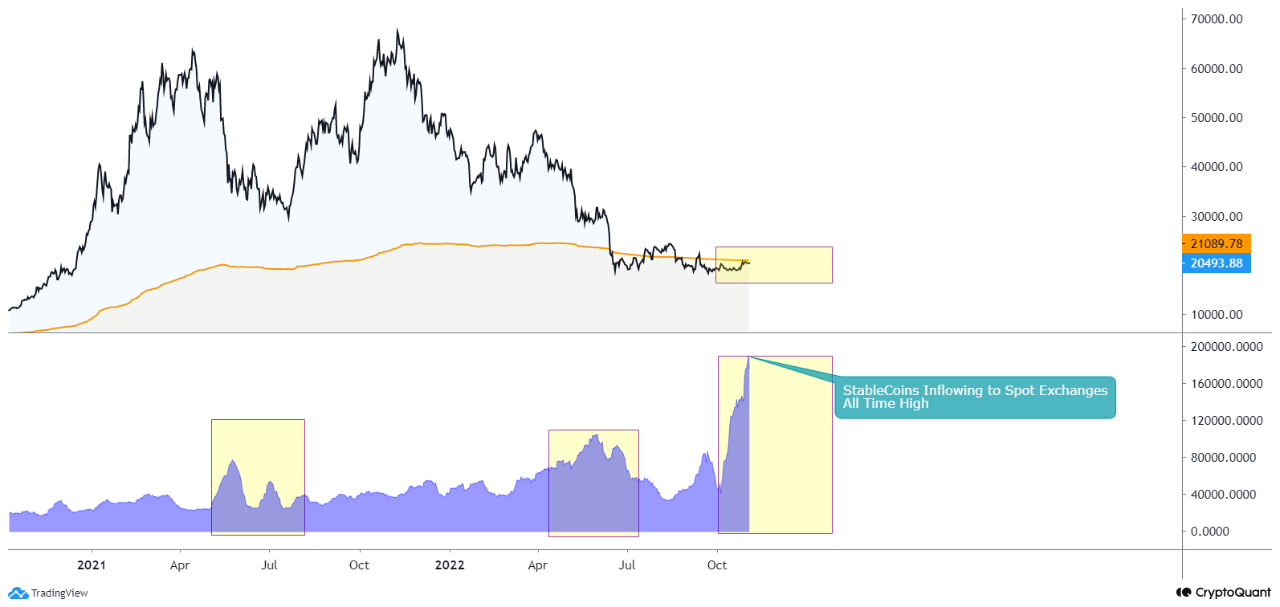

Stablecoin Exchange Inflow Mean Hits ATH, Why This Could Be Bullish For Bitcoin

On-chain data shows the stablecoin exchange inflow mean has reached a new all-time high, here’s why this might prove to be bullish for Bitcoin. Stablecoin Exchange Inflow Mean Has Surged Up To A New ATH Recently As pointed out by an analyst in a CryptoQuant post, these inflows can be positive for Bitcoin in the long term, but might be bearish in the short term. The “stablecoin exchange inflow mean” is an indicator that measures the average amount of stablecoins per transaction going into the wallets of centralized exchanges. As stablecoins are relatively stable in value....

Related News

On-chain data shows that shortly after crypto exchange Binance observed Bitcoin inflow of around 12k BTC, price fell by almost 5%. Huge Bitcoin Inflow To Binance As pointed out by a CryptoQuant post, inflow of around 12k BTC was seen on Binance, the largest crypto exchange by market volume. The Bitcoin inflow is an indicator that shows the total amount of BTC transferred to a crypto exchange from a personal wallet. As investors usually send their crypto to exchange wallets for cashing out, altcoin purchasing, etc., the indicator’s value going up would imply there is some selling....

On-chain data shows the USDC exchange inflow has spiked up. Historically, stablecoins have provided dry powder for kicking off new Bitcoin rallies. USDC Exchange Inflow Sharply Rose To High Values Recently As explained by an analyst in a CryptoQuant post, almost one billion USDC has flowed into exchanges recently. Past pattern suggests this may lead to uptrend for Bitcoin. The “USD Coin exchange inflow” is an indicator that measures the total amount of the stablecoin entering wallets of all exchanges within a given period. When the value of this indicator moves up, it means....

On-chain data shows a recent rise in the number of stablecoin addresses sending to exchanges, suggesting an increase in dry powder supply pumping into Bitcoin. Stablecoins Exchange Inflow Addresses Count Recently Surges As pointed out by a CryptoQuant post, the number of stablecoin addresses making inflow transactions to exchanges saw a sharp rise yesterday. Stablecoins are tokens that have their values tied to a fiat currency. Since they are relatively stable (as their name suggests), investors like to use them for temporarily pulling out of volatile markets like Bitcoin. The “all....

On Sunday, February 21, the price of bitcoin touched a new all-time high (ATH) at $58,354 and at the time, inflow into exchanges spiked as well. According to data from the onchain analysis firm, Santiment, stats indicate that exchange inflow jumped 11x on Sunday and data also shows one whale address was responsible for the second-largest bitcoin transaction in 2021. Second-Largest Bitcoin Transaction and 11x the Exchange Flow Shakes the Crypto Market Bitcoin prices jumping to new heights has sparked a lot of crypto market movement in recent months and even ancient UTXOs waking up after....

Stablecoins like Tether are flooding crypto exchanges again, potentially pointing at another upward move on crypto markets. Amid renewed bullish action on cryptocurrency markets, stablecoins like Tether (USDT) are flooding exchanges to hit a new historical high in terms of allocation.According to market data provider CryptoQuant, stablecoin holdings on global crypto exchanges broke a new all-time high on Jan. 28, surpassing $4.7 billion.This amount makes up a significant part of the total stablecoin market capitalization, which is estimated at around $35.2 billion at the time of writing,....