Ethereum Price Slips Below $2,500 — Sell Volume Suggests Mounting Bearish Pre...

The Ethereum price struggled to break out of the $2,500 – $2,700 range over the past week, mirroring the sluggish condition of the general market. On Friday, June 20, the altcoin succumbed to a fresh wave of bearish pressure, falling toward the $2,400 mark to close the week. Unsurprisingly, this latest downturn appears to be […]

Related News

The price of Avalanche (AVAX) slips at $30 against Tether (USDT) as Avalanche (AVAX) eyes key support to hold the price from selling off. AVAX showed great strength rallying to a high of $30 but was rejected as Bitcoin’s (BTC) price continued to go lower, affecting the price of AVAX from trending higher. (Data from Binance) Related Reading: Why Bitcoin Is Oversold As BTC Reclaims Territory North Of $20,000 Avalanche (AVAX) Price Analysis On The Weekly Chart According to the chart, the price of AVAX had a strong bullish bias at $30, but the price was rejected from that region,....

Recent trading activities reveal that PEPE is under mounting selling pressure as its price falls below the critical $0.00000766 support level. This dip signals a further bearish move, with bears gaining control and eyeing further downside towards the $00000589. The break below this key level raises concerns among traders, as the possibility of deeper losses becomes increasingly likely. As momentum turns negative, this article aims to examine the implications of PEPE’s price slipping below a critical support level. It will delve into how this breakdown impacts market sentiment, and with the....

Data suggests users on Binance responded to the Ethereum exchange-traded fund (ETF) news by aggressively longing the cryptocurrency. Ethereum Net Taker Volume On Binance Has Just Seen Its Biggest Candle Ever As explained by CryptoQuant community manager Maartunn in a post on X, the Ethereum Net Taker Volume has observed a sharp increase after rumors have surfaced that the ETH spot ETFs have a renewed chance of gaining approval. The “Net Taker Volume” here refers to an indicator that keeps track of the difference between the ETH taker buy and taker sell volumes on any given....

Ethereum has slid on its charts again at the time of writing. Over the last week, the coin lost about 10% of its value. The bears have strengthened in the market because the buyers have left the market. Technical outlook of the coin remained bearish and selling pressure mounted. The coin would continue to remain so over the next trading sessions. The coin also witnessed a sustained sell-off over the last 48 hours. Ethereum fell below its long standing support line of $1900.Over the last 24 hours the coin tried to recover itself but the bearish price action is still strong at the time of....

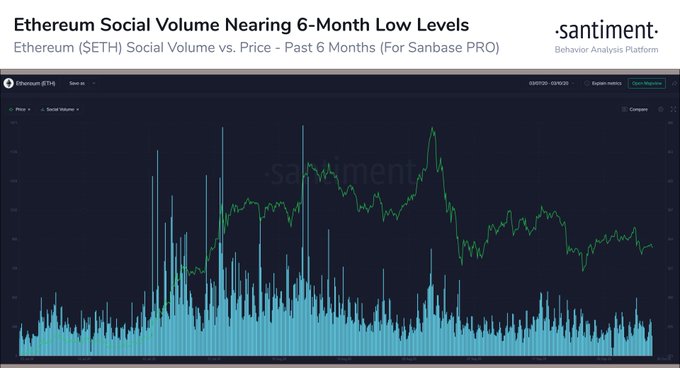

Ethereum’s price has slipped lower over recent weeks as other markets have also slumped. Simultaneously, activity on the blockchain itself has slowed as yield farming opportunities have dried up, with many reaching a point where they became grossly unsustainable. This may not be the end of the world, though, as fundamental and technical trends suggest ETH may soon revert higher. Ethereum Social Volume Plunges as Price Slips Lower Due to a slowdown in ETH’s price […]