Litecoin is trading at a 1,800% premium via Grayscale's LTC Trust — But why?

Investors looking to gain LTC exposure using traditional equities are willing to pay a premium of more than 1,800% to buy it via Grayscale's Litecoin Trust. Shares in Grayscale Investments' Litecoin Investment Trust, or LTCN, have been trading at a whopping 1,800% premium over the market rate of their underlying asset, Litecoin (LTC).$319 per Litecoin? This difference is caused primarily due to retail investors' inability to purchase shares directly from Grayscale Investments, whose funds are aimed exclusively at accredited investors.LTC holdings per $LTCN share (orange) and premium....

Related News

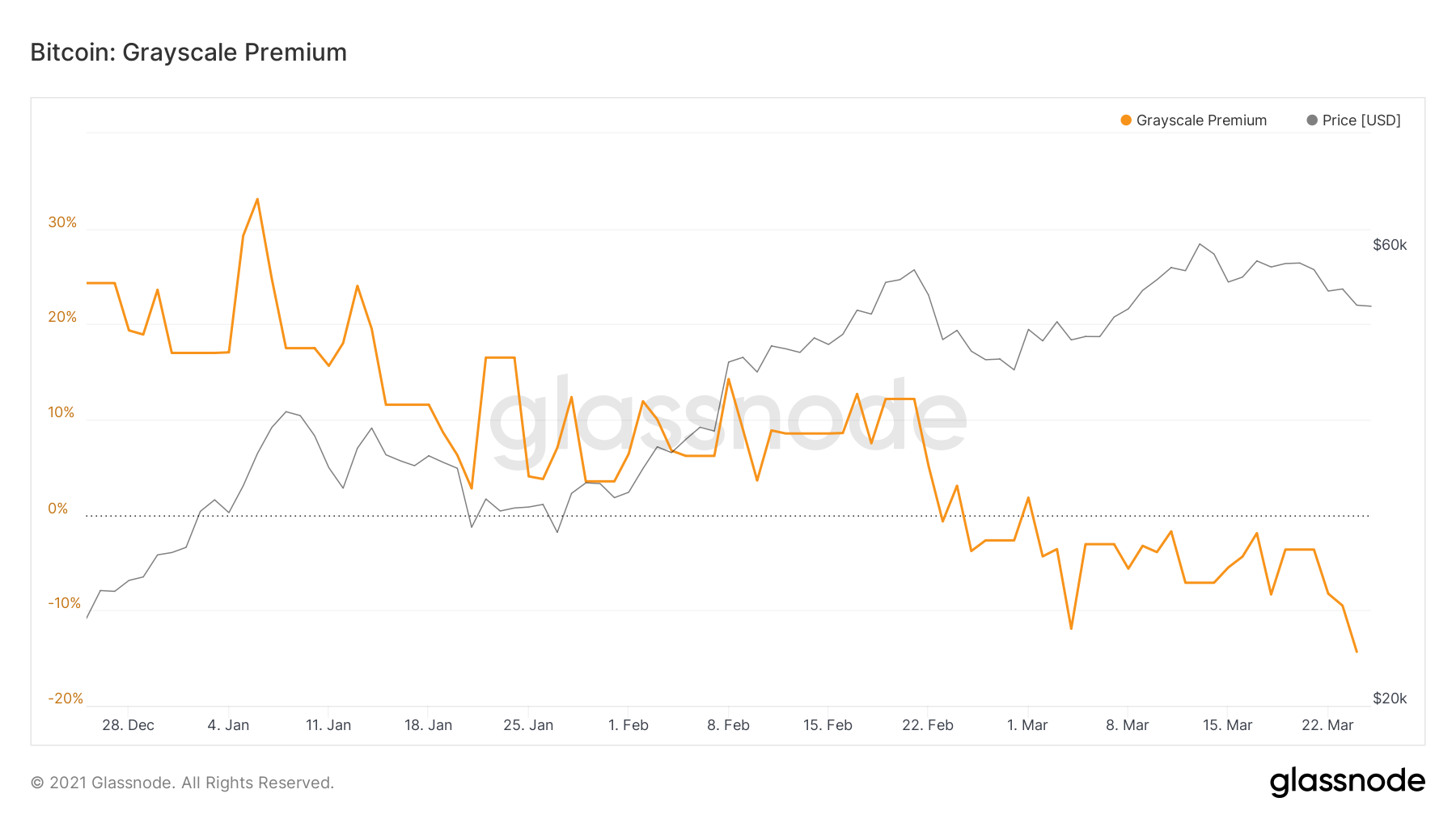

Since trading at a negative for nearly 2 months, GrayScale Bitcoin Trust (GBTC) premium plummeted to -14.21% this morning. Historically, GBTC has traded at a high premium relative to the underlying Bitcoin, commanding an average of 15.02% premium since the fund’s inception. But as competition grows and firms create cheaper, more accurate financial products, GBTC’s appeal has dropped dramatically — and its premium clearly shows for it. Analyzing Why Grayscale Bitcoin Trust Premium Continues to […]

Grayscale Bitcoin Trust's premium is now above 30% as institutional demand for BTC continues to increase. The demand for the Grayscale Bitcoin Trust (GBTC) continues to rise with its premium surpassing 30% on Dec. 3. This indicates that Bitcoin (BTC) is seeing increasing institutional demand as its price consolidates above $19,000.The Grayscale Bitcoin Trust is an institutional vehicle that is tradable in the United States through OTC markets. Accredited and institutional investors typically use the trust to obtain exposure to BTC with their brokerage accounts.Why is the Grayscale Bitcoin....

For the past two months, Grayscale Bitcoin Trust (GBTC) has traded at a negative premium to the net asset value (NAV). GBTC historically traded at a high premium relative to the underlying, averaging a 15% premium since the fund’s inception. This was largely due to GBTC being the only investment vehicle easily accessible to institutional […]

Since February, Grayscale’s premier crypto fund Grayscale Bitcoin Trust (GBTC) has traded at a negative premium to its net asset value (NAV). GBTC, which has been the largest publicly-traded crypto fund available on the market, saw its historically high premium plummet as new competition weighed in. In the past, institutional investors had to accept GBTC’s […]

Earlier this Monday, Grayscale Investments announced its plans to transform Grayscale Bitcoin Trust (GBTC) into an exchange-traded fund. Up until recently, GBTC was one of the only investment funds for institutions and retail investors alike. Amidst growing competition, however, the fund’s high management fees and stringent lock-up periods lost favor with many investors. Since February, GBTC had continued to trade at a negative premium — meaning that the fund was trading below the price of […]