Bitcoin's Coinbase premium turned negative. Here's what it means for BTC price

Coinbase Pro is a major bellwether for institutional demand. Now, data from CryptoQuant indicates that short-term selling pressure on Coinbase is mounting. Bitcoin’s (BTC) definitive breakout above $50,000 may have to wait longer to materialize as spot buying pressure on Coinbase Pro shows signs of weakening — at least, in the short term. The Coinbase Premium Index, which measures the gap between the BTC price on Coinbase Pro and Binance, has flipped negative, according to CryptoQuant. In other words, selling pressure on Coinbase appears to be strengthening compared with other exchanges....

Related News

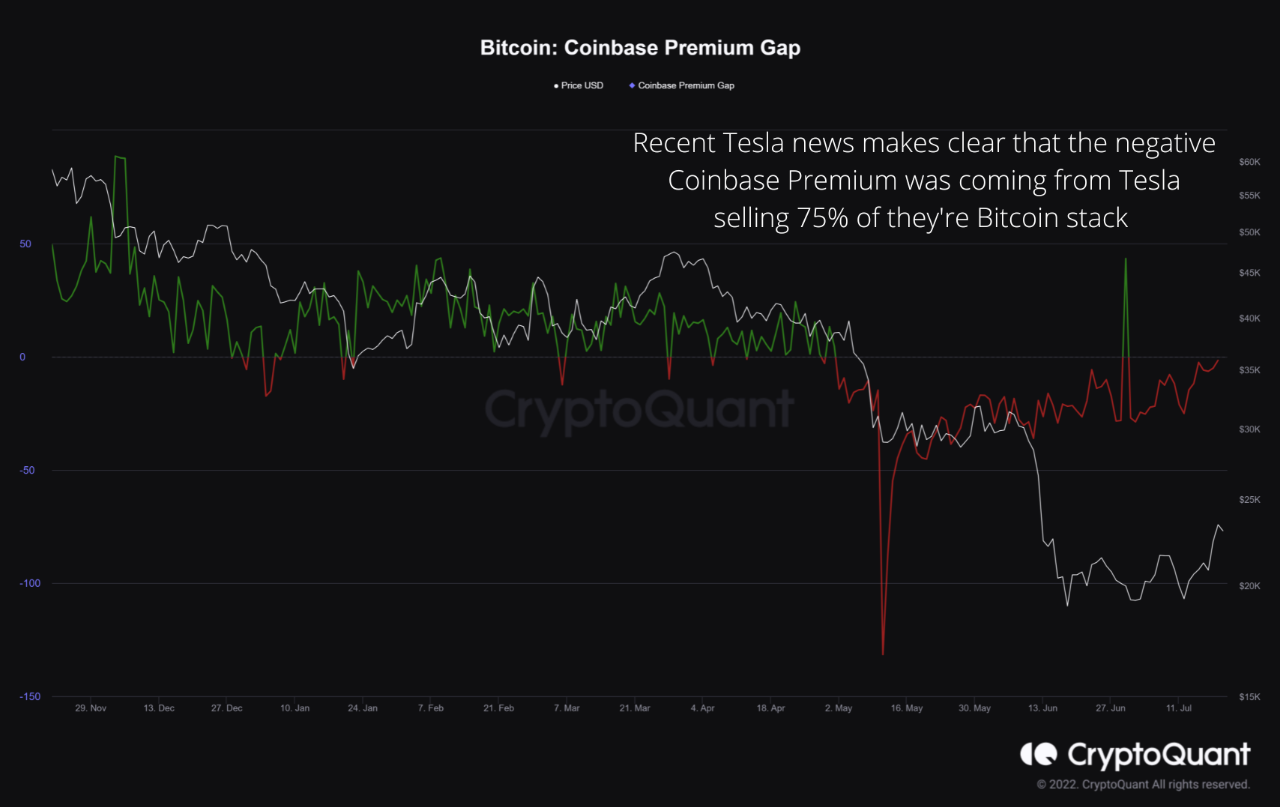

On-chain data shows the Bitcoin coinbase premium gap has improved recently and is now approaching a neutral value, suggesting the selling pressure may be drying up. Bitcoin Coinbase Premium Gap Close To Zero, But Still Negative As pointed out by an analyst in a CryptoQuant post, the selling pressure from US investors seems to have reduced in recent days. The “Coinbase Premium Gap” is an indicator that measures the difference in the Bitcoin prices listed on crypto exchanges Coinbase (USD pair) and Binance (USDT pair). The quant notes that US investors are known to use the....

A negative premium implies that accumulation will last a little longer, meaning that $50,000 as support may have to wait too. Bitcoin (BTC) has already hit $50,000 on some exchanges but needs to get whales on its side to flip it to definitive support, data suggests.In a tweet on Feb. 16, Ki Young Ju, CEO of on-chain analytics service CryptoQuant, highlighted the so-called "Coinbase premium" as one of the final hurdles for BTC/USD.Negative premium slows upward grindOn Tuesday, a clear battle was emerging within Bitcoin trading as $50,000 stayed de facto out of reach for bulls.Analyzing the....

Data shows the Bitcoin Coinbase premium gap has surged up to positive values, suggesting that buying from investors on the exchange could be behind the pump to $22k. Bitcoin Coinbase Premium Gap Observes Sharp Rise To Positive Values As pointed out by an analyst in a CryptoQuant post, after many months of negative values, the Coinbase premium gap is now above zero. The “Coinbase premium gap” is an indicator that measures the difference between the Bitcoin price on Coinbase Pro (USD pair) and the value on Binance (USDT pair). Since Coinbase is popularly used by US investors....

The price of Bitcoin broke $50,000 on futures exchanges and several data points suggest the U.S. session could see the rally continue. The price of Bitcoin (BTC) surpassed $50,000 for the first time in history across major futures exchanges, including Binance Futures.However, on spot exchanges, like Coinbase and Binance, the price of Bitcoin rejected closely below $50,000.BTC/USD 1-hour candle chart (Binance Futures). Source: TradingviewWhy more upside is likelyOn Feb. 16, the price of Bitcoin reached as high as $49,556 on Coinbase, marking its second attempt at breaking past the $50,000....

A quant has suggested that the reason behind the recent negative Coinbase Premium could have been due to Tesla’s Bitcoin selling. Tesla Dumping 75% Of Its Bitcoin Holdings Might Be Behind Negative Coinbase Premium Gap As explained by an analyst in a CryptoQuant post, the news about Tesla selling off 75% of its BTC stash […]