Bitcoin Bullish Signal: 1k-10k BTC Holders Have Been Buying Recently

On-chain data shows Bitcoin whales holding between 1k to 10k BTC have expanded their reserves recently, a sign that could be bullish for the crypto’s price. Bitcoin Reserves Of 1k-10k BTC Holders Have Observed Growth Recently As explained by an analyst in a CryptoQuant post, the whales holding between 1k to 10k BTC have shown smart-money behavior in the past as they usually buy near bottoms and sell near tops. The relevant metric here is the total amount of coins currently being held by the different holder groups in the Bitcoin market. The criteria for grouping the investors here is....

Related News

On-chain data shows that large Chainlink holders have been buying during the past two weeks, a sign that’s positive for the coin’s rally. Chainlink Sharks & Whales Have Added Another $53 Million In LINK As pointed out by analyst Ali in a post on X, the large LINK investors have been buying recently. The indicator […]

On-chain data shows the number of Bitcoin holders with 10k+ BTC have grown recently, a sign of accumulation from whales. Number Of Bitcoin Whales Holding 10k Or More BTC Has Gone Up Recently As pointed out by an analyst in a CryptoQuant post, both the 1k+ and 10k+ BTC holders have observed some growth in recent weeks. Holders with 1k or more BTC are considered whales, and movement from them can have noticeable impacts on the Bitcoin market. The relevant indicator here looks at all wallets on the network to see how many own between 1k and 10k BTC and how many are holding more than 10k BTC.....

Latest data from Glassnode shows Bitcoin long-term holders currently own around 90% of the total supply in profit. Bitcoin Supply In Profit Share Of Short-Term Holders Declines According to the latest weekly report from Glassnode, dominance of long-term holders has observed rise recently. The relevant indicator here is the “supply in profit,” which measures the total number of coins that are currently holding a profit in the Bitcoin market. The metric works by checking the on-chain history of each coin to see what price it was last sold at. If this previous price was less than....

Data released by Glassnode suggests Bitcoin long-term holder behavior has shifted from accumulation to distribution recently. Bitcoin Long-Term Holders Have Shed 222k Coins Off Their Stack Since May As per a new report from Glassnode, the BTC long-term holders have been spending up to 47k BTC per month in recent days. The “long-term holders” (or LTH in short) refer to the cohort of Bitcoin investors that have been holding onto their coins since at least 155 days ago, without selling or moving them. The “LTH net position change” is an indicator that measures the net....

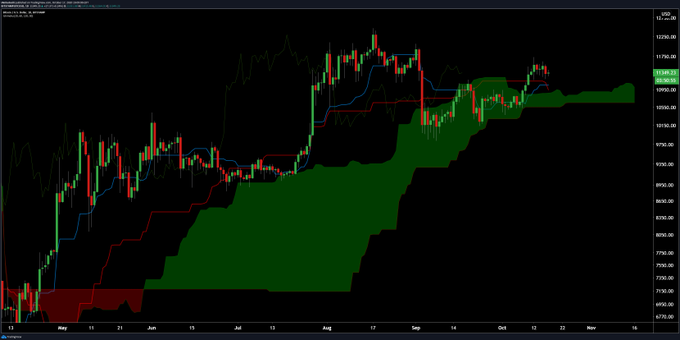

Bitcoin is forming a pivotal buying signal after weeks of consolidation. The cryptocurrency pushed higher over the past 10 days, which allowed this indicator to trend higher to form the buying signal seen today. Bitcoin Prints Pivotal Ichimoku Cloud Crossover Josh Olszewicz, a crypto-asset analyst, recently noted that the cryptocurrency formed a bullish TK Cross as per the Ichimoku Cloud indicator. The indicator is a multi-faceted indicator that shows important price levels along with the […]