ETH-BTC Ratio Shifting: Is An Ethereum Mega Rally Incoming?

Ethereum prices are firm at spot rates, still trading above the $2,000 level, and multiple other factors point to possible trend continuation. According to Kaiko’s data on November 12, not only is the ETH-BTC ratio shifting and reversing after extended periods of lower lows, but also there is a notable uptick in trading volume with funding rates in crypto derivative platforms shifting from negative to positive, suggesting increasing demand. Ethereum Breakout Above $2,000 As of writing on November 13, Ethereum is relatively firm and changing hands at around the $2,090 level. Despite....

Related News

On-chain data shows the Ethereum MVRV ratio is currently testing a level that has historically served as the boundary between bear and bull markets. Ethereum MVRV Ratio Is Retesting Its 180-Day SMA Right Now The “Market Value to Realized Value (MVRV) ratio” is an indicator that measures the ratio between the Ethereum market cap and realized cap. The former is naturally just the total supply valuation at its spot price. At the same time, the latter is an on-chain capitalization model that calculates the value differently. The realized cap assumes that the real value of any coin....

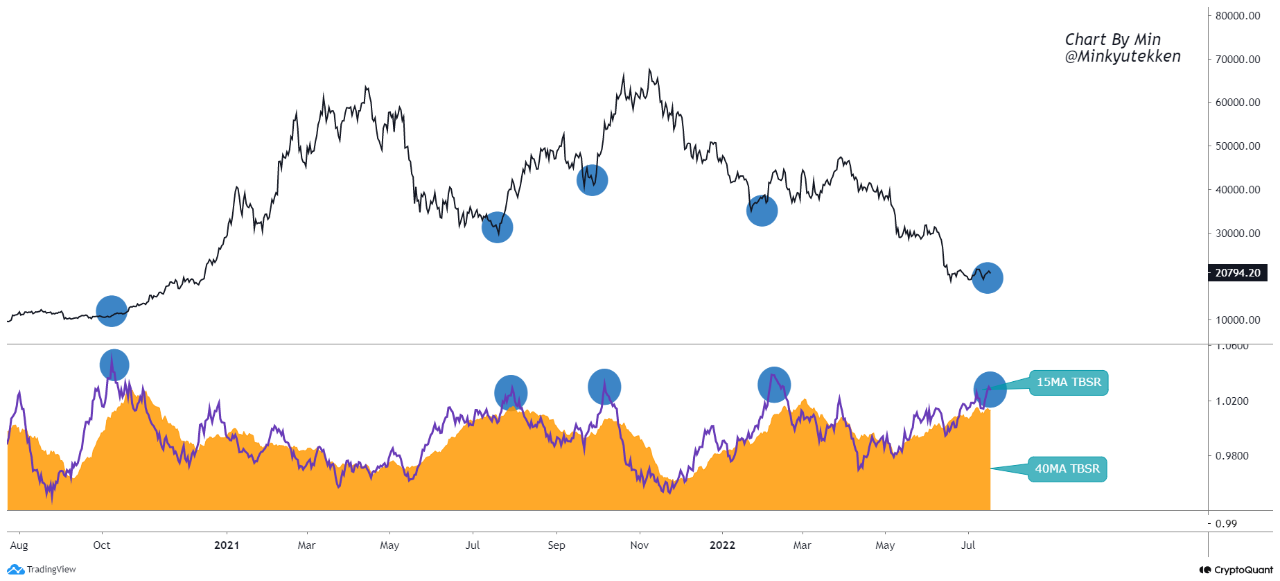

On-chain data shows the Bitcoin taker buy/sell ratio started showing a green signal shortly before the surge above $22k. Bitcoin Taker Buy/Sell Ratio Is Now Showing a “Buy” Signal As pointed out by an analyst in a CryptoQuant post, the BTC taker buy/sell ratio suggested a bounce not too long before the rally today. The […]

On-chain data shows Bitcoin leverage ratio has hit a new all-time high (ATH). This may mean that a price correction could soon follow. Bitcoin Leverage Ratio Reaches New Highs, Correction Incoming? As pointed out by an analyst in a CryptoQuant post, the BTC leverage ratio has made a new ATH recently. This increases the possibility of a correction happening soon to flush out all the excess leverage. The “all exchanges estimated leverage ratio” is an indicator that estimates how much leverage is used by Bitcoin investors on derivatives exchanges, on average. There are two related....

Macro-economist Henrik Zeberg thinks Bitcoin (BTC) and other risk assets are gearing up for a “monster” move, with the trend still in its early stages. Zeberg’s predictions are based on the BTC/SPX Ratio, an indicator that compares Bitcoin’s performance to the S&P 500 index (SPX). BTC/SPX Ratio Says There Is A Monster Move Incoming Despite recent fluctuations and concerns about the crypto market’s sustainability, Zeberg remains bullish on BTC. In the analyst’s view, the BTC/SPX Ratio offers strong evidence that the Bitcoin uptrend is “just....

Another bullish prediction has come in for the XRP price which is arguably more optimistic than many would expect. This time around, a crypto analyst is expecting XRP to use up its stored energy for an explosive rally that could see the altcoin rally to $27, well above its all-time high. XRP Price Suppressed During Last Bull Run Because Of SEC Lawsuit Crypto analyst ERGAG CRYPTO recently predicted that XRP is poised for a massive 4,000% price surge. ERGAG made this prediction in an X post, detailing how this price surge can be actually possible. According to the analyst, XRP’s price....