JPMorgan Economist Expects the Fed to Hike Benchmark Rate by 75 bps as Global...

The U.S. Federal Reserve is expected to raise the federal funds rate during its next meeting on Wednesday and JPMorgan economist Michael Feroli believes that rising inflation will push the Fed to increase the rate by 75 basis points (bps). Last week, CME Group data indicated the market priced in a 95% chance that the U.S. will see a 50 bps rate hike this month. Although, while some expect a hawkish Fed, some believe the U.S. central bank may act dovishly if markets get worse. Global Markets Shudder With Focus Directed at the Fed’s Next Rate Hike — JPMorgan Economist....

Related News

After seeing Ghana’s inflation rate surge to 31.7% in July, the Bank of Ghana responded by hiking the benchmark interest rate by 300 basis points. In addition to the rate hike, the central bank said it will gradually raise banks’ primary reserve requirements. One expert has said President Nana Akufo-Addo must trim the size of his government. Largest Benchmark Rate Hike Since 2002 In an attempt to tame the country’s runaway inflation rate, which topped 31.7% in July, the Ghanaian central bank hiked the benchmark interest rate by 300 basis points. Following the latest....

Following the recent U.S. consumer price index report that indicated inflation in America has reached a 40-year high, many expect the Federal Reserve to hike the benchmark interest rate by 75 to 100 basis points (bps) on July 26. Blackstone’s Private Wealth Solutions expects the Fed to raise the rate by 75 bps and bankrate.com believes a three-quarter rate hike is in the cards as well. All Eyes on the Fed’s Next Move — Market Strategists Predict a 75 to 100 bps Interest Rate Hike Next Week Next week, roughly six days from now, the U.S. central bank will meet once again....

On Wednesday, the U.S. Federal Reserve raised the federal funds rate by 75 basis points (bps) in order to tame inflation and stabilize the American economy. The recent rate hike is the U.S. central bank’s third rate increase after increasing the benchmark rate by 50 bps last March. Fed Hikes Rate by 75 bps for a Second Time in a Row to Tame Inflation, Central Bank Says ‘Inflation Remains Elevated’ With inflation scorching hot in America, the U.S. Federal Reserve has raised the federal funds rate once again, increasing it by 75 bps on Wednesday afternoon at 2:00 p.m.....

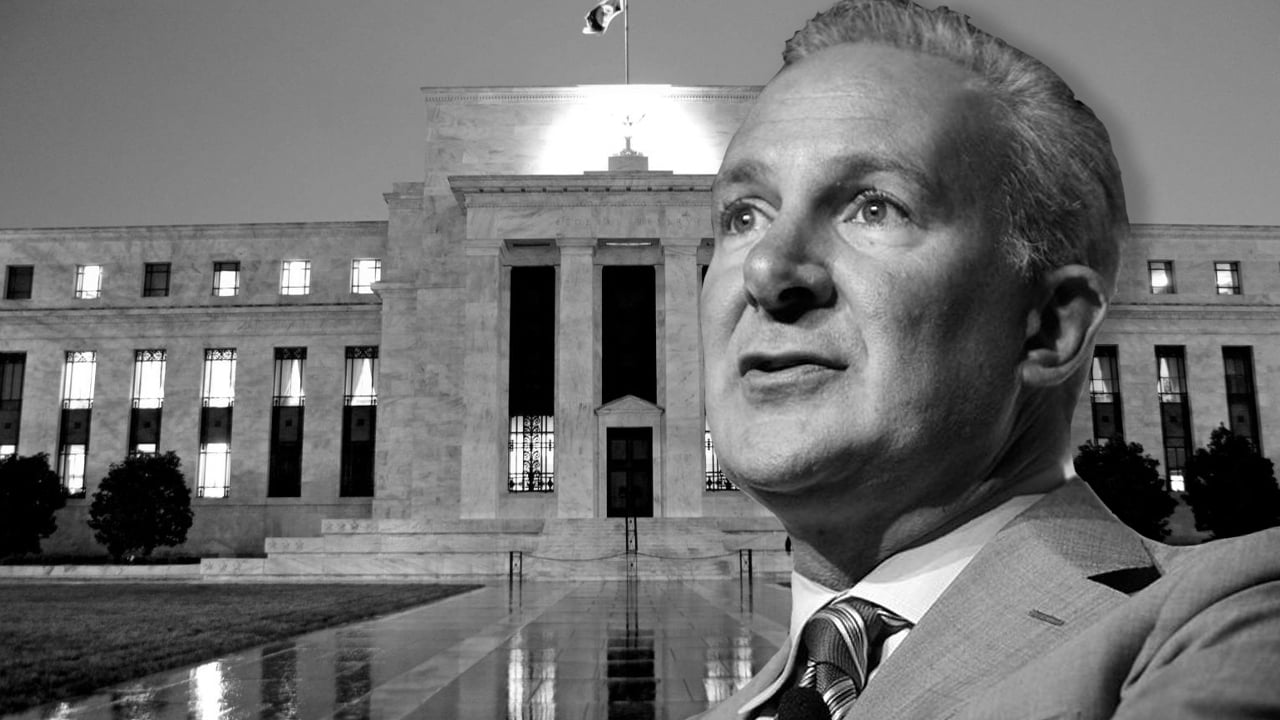

Following the Federal Reserve’s rate hike on Wednesday, economist Peter Schiff has had a lot to say since the U.S. central bank raised the benchmark rate by half a percentage point. Schiff further believes we are in a recession and says “it will be much worse than the Great Recession that followed the 2008 Financial Crisis.”

Peter Schiff Says ‘Fed Cant Win a Fight Against Inflation Without Causing a Recession’

While many analysts were shocked by the U.S. Federal Reserve’s move, since it was the largest rate hike since 2000, a report by....

On Thursday, the European Central Bank (ECB) announced the central bank’s third consecutive benchmark bank rate increase this year, raising the rate by 75 basis points (bps). In addition to the rate hike, the ECB changed the central bank’s targeted longer-term refinancing operations terms and conditions noting that they need to be “recalibrated.” ECB Hikes Rate in Attempt to Curb Red-Hot Inflation Eight days ago, the European Union’s statistics office Eurostat published the latest inflation report for September. Eurostat’s records indicated that Euro area annual inflation jumped to 9.9% in....