The Bankchain Part III: Issuing IOUs

The concept of bankchains is quite appealing to people active in the financial sector, but the inherent issues and questions associated with this tool need to be addressed first. Besides issuing currencies over the bankchain, the ability to issue different products can also be a powerful tool. Even though hardly anyone in the Bitcoin community is in....

Related News

Slock.it DAO token IOUs to go on sale Thursday, according to William Piquard, business developer at Gatecoin Limited, a Hong Kong based regulated financial institution for blockchain assets. The much anticipated DAO, which aims to fund the creation of smart locks as well as an Ethereum computer with more than 4,000 members flocking to their Slack channel, has not itself yet been released. On Wednesday 27 April, Piquard stated : “[T]he Decentralized Autonomous Organization may not be created tomorrow, but Gatecoin users will be able to buy DAO token IOUs from tomorrow to....

In our previous article, we discussed the trials and tribulations surrounding the concept of bankchains, and what challenges this technology poses. At the same time, it is clear for anyone to see how the benefits outweigh the costs. But what else can these bankchains do besides replacing the banking infrastructure? In a traditional business environment,....

Paxos, a global securities depository and blockchain technology provider, has completed a pilot test for Euroclear Bankchain, a settlement service for London bullion. The service combines Euroclear’s settlement activities with Paxos’ blankchain platform. The service is designed to reduce risk, improve efficiency, and minimize balance sheet constraints for gold market participants. Bullion Traders Participate In Test. More than 600 OTC bullion trades settled in a two-week period for banks including Citigroup, Scotiabank, MKS PAMP, Societe Generale and INTL FCStone. All are part of the....

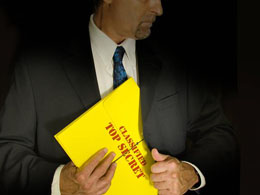

ItBit has revealed new details about its formerly top-secret Bankchain project, a private consensus-based ledger system aimed at appealing to enterprise financial institutions. With the formal unveiling, the New York-based bitcoin exchange has joined the number of blockchain firms seeking to compete for the attention of banks that want to utilize the efficiencies of distributed databases without using bitcoin or its blockchain. In a new interview, Steve Wager, head of global operations for itBit, spoke at length about the project, rumors of which first began surfacing in late July.....

Over the course of three previous articles, the pros and cons of the bankchain concept have been thoroughly discussed. Even though most Bitcoin enthusiasts don’t see a viable future for private blockchains in the banking system, there are still a few aspects left to discuss. Regulation of bankchains will be important, and it remains to be seen how the....