The Bankchain Part IV: Centralized Exchanges & KYC Procedures

Over the course of three previous articles, the pros and cons of the bankchain concept have been thoroughly discussed. Even though most Bitcoin enthusiasts don’t see a viable future for private blockchains in the banking system, there are still a few aspects left to discuss. Regulation of bankchains will be important, and it remains to be seen how the....

Related News

The concept of bankchains is quite appealing to people active in the financial sector, but the inherent issues and questions associated with this tool need to be addressed first. Besides issuing currencies over the bankchain, the ability to issue different products can also be a powerful tool. Even though hardly anyone in the Bitcoin community is in....

Paxos, a global securities depository and blockchain technology provider, has completed a pilot test for Euroclear Bankchain, a settlement service for London bullion. The service combines Euroclear’s settlement activities with Paxos’ blankchain platform. The service is designed to reduce risk, improve efficiency, and minimize balance sheet constraints for gold market participants. Bullion Traders Participate In Test. More than 600 OTC bullion trades settled in a two-week period for banks including Citigroup, Scotiabank, MKS PAMP, Societe Generale and INTL FCStone. All are part of the....

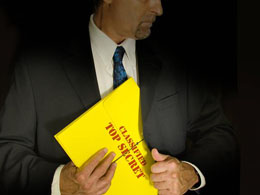

ItBit has revealed new details about its formerly top-secret Bankchain project, a private consensus-based ledger system aimed at appealing to enterprise financial institutions. With the formal unveiling, the New York-based bitcoin exchange has joined the number of blockchain firms seeking to compete for the attention of banks that want to utilize the efficiencies of distributed databases without using bitcoin or its blockchain. In a new interview, Steve Wager, head of global operations for itBit, spoke at length about the project, rumors of which first began surfacing in late July.....

New York-based bitcoin exchange itBit is set to host a private gathering of financial industry professionals on Monday, 27th July. The all-day, invite-only "Bankchain Discovery Summit" will be held at one of the city's Convene locations, a meeting space provider operating in both New York and Washington, DC. Expected attendees are said to draw largely from major banks, brokerages and exchanges. An invitation obtained by CoinDesk reads: "Join us for the inaugural itBit Bankchain Discovery Summit. Interact with industry peers, hear from our panel of experts and address topical blockchain use....

The Centralized Bitcoin exchanges seem to coordinate their prices across continental divides. One goes down - they all go down. The question is why the public tolerates their scam. If they were useful or desirable, they'd consider the very people who sustain the Bitcoin network, namely Bitcoin miners who, below $400, likely operate at a loss. Exchange clients and miners get whatever is happening in the busiest exchange. The exchanges' arbitrage-bots equalize prices between one another. Miners - you're the backbone of this innovation. Cryptomonkeys - you think you're trading - but your....