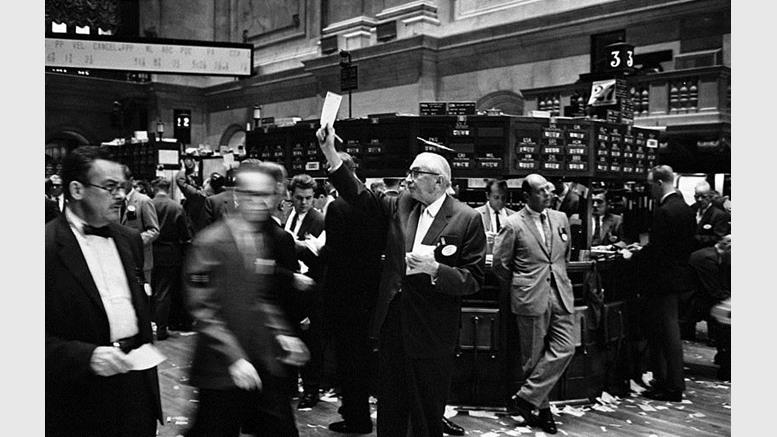

NYSE to Introduce New Bitcoin Price Index

The New York Stock Exchange (NYSE) is reportedly planning to introduce a special global price index to value Bitcoin, a decentralized digital currency-cum-technology. As reported by Mashable, the world's largest stock exchange is in the process to launch the Bitcoin price index through its Global Index Feed. It is further planning to make the index available free on its website, though for a limited time. The news website also managed to obtain a quote from the NYSE's President, Mr. Tom Farley, who confirmed their plans to launch the Bitcoin index. "We are now going to use our name,....

Related News

The New York Stock Exchange (NYSE) has today announced the launch of a bitcoin price index (NYXBT). NYXBT will represent the daily US dollar value of one bitcoin at 4pm (BST) and will be published on the NYSE Global Index Feed (GIF). For a limited period it will also be viewable on the NYSE's website. Thomas Farley, NYSE group president, said in a statement: "Bitcoin values are quickly becoming a data point that our customers want to follow as they consider transacting, trading or investing with this emerging asset class." He added: "As a global index leader and administrator of ICE LIBOR,....

In a new move to cater to the increasing investor appetite for crypto assets spurred by the new regulatory dawn, the S&P Dow Jones Indices has unveiled the S&P Digital Markets 50 index. Announced on Tuesday, this new index aims to provide investors diversified exposure to the cryptocurrency landscape and related stocks. S&P’s Response To […]

Former New York Stock Exchange (NYSE) CEO and Goldman Sachs partner Duncan Niederauer has joined regulated bitcoin futures exchange TeraExchange. The former NYSE exec will serve as an advisory director, providing insight to the increasingly bitcoin-focused firm. Niederauer retired from his position in 2014, having held the post since 2007. TeraExchange CEO Christian Martin explained that Niederauer will most importantly help the company develop its strategy and to capitalize on available market opportunities. Martin told CoinDesk: "Duncan has great pedigree when it comes to market....

S&P Global has announced its plan to launch the S&P Digital Markets 50 Index. It will expand its S&P Dow Jones Indices and collaborate with tokenized US securities provider Dinari. The index, as explained in S&P’s press release, will merges 15 cryptocurrencies with 35 publicly traded blockchain-linked equities. It’ll also introduce diversified exposure to digital-assets […]

The New York Stock Exchange today launched its NYSE Bitcoin Index (NYXBT) to track the price of bitcoin and give the digital currency's value a definitive global benchmark. This move by one of the largest and most influentialstock exchanges in the world gives bitcoin new legitimacy and "gravitas" and may seal its spot in first place as the digital currency of choice. New York Stock Exchange President Thomas Farley made the announcement today saying in a news release:"Bitcoin values are quickly becoming a data point that our customers want to follow as they consider transacting, trading or....