Bitcoin Derivative Platform Announces Back-Office Blockchain Project

A bitcoin derivative trading company has announced that it is working on a "secret" back-office blockchain project. Magnr, known to offer Bitcoin saving accounts with a fixed interest rate, has launched "Project Kodo" with the hope of resolving the inefficient backend processes in financial assets trading, the IBTimes reported. The company has also appointed a new Chief Executive Officer (CEO), Colin Kwan, to oversee the said project. A former employee at Deutsche Bank and UBS, Kwan's involvement into the Project Kodo is hopeful to bring a lot of technological and banking expertise to the....

Related News

As the hype and pessimism around blockchain technology converge toward reality over the next several years, one certainty emerging among Wall Street and Main Street traders is that advancements in platform technology will profoundly change how commonly used securities known as derivative contracts will be traded. The distributed ledgers inconceivable just a couple of years ago are on the precipice of ushering in a new era of innovative financial engineering and precision in risk management. Wall Street firms are beginning to tinker with blockchain and smart contract technology that will....

A group of banks is testing blockchain technology as a way to better manage reference data for the products they trade. Seven banks, including Citi, HSBC and Alliance Bernstein (AB), has joined R3, a bank consortium studying blockchain, and Axoni, a blockchain technology firm that uses blockchain in settling derivative transactions, to determine if the technology can simplify reference data processes, according to Axoni. Banks Complete Proof Of Concept. Working through the Securities Industry and Financial Markets Association (SIFMA), the companies completed a proof of concept (PoC)....

The Smart Dubai Office, a government-backed initiative led by the Crown Prince of Dubai has partnered a FinTech specialist firm to implement a citywide payments platform based on blockchain technology. The government initiative has entered a memorandum of understanding (MoU) with FinTech consulting and development firm Avanza Solutions, signed in the presence of Hamdan bin Mohammed, the hereditary Prince to the crown of Dubai. Announced by Avanza quietly last week, the sweeping citywide project planned by the Smart Dubai Office will see a rollout of the blockchain payments platform to all....

Through an exclusive partnership with real estate tech startup Velox.re, Chicago’s Cook County will test the use of the Bitcoin blockchain for transferring and tracking property titles and other public records. The Cook County Recorder’s Office is the second largest such office in the United States, and it it will be the first in the country to experiment with blockchain technology. Specifically, the office will be testing blockchain applications of property title transfer and a system for filing liens; compatibility between a blockchain and a traditional, server-based setup; fraudulent....

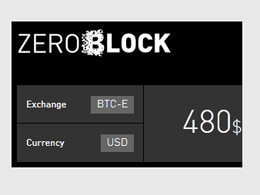

ZeroBlock Trading Platform Adds BTC-e. ZeroBlock's trading platform "will allow traders consolidated access to much of the liquidity in the Bitcoin market." Blockchain has been making large strides in the Bitcoin world over the last few months. Blockchain.info has taken custodial custody of bitcoin.com, the premier landing page of our generation, and given it a revamp. Before that project, Blockchain bought ZeroBlock, a news aggregation app, in December of 2013 and also RTBTC, a trading platform, in March of 2014. Today, Blockchain's acquisitions have culminated into the ZeroBlock Trading....