Why the Bitcoin ‘mid-halving’ price slump will play out differently this time

The $50,000 resistance level seems to be the line in the sand that separates certainty from doubt that Bitcoin has cast off the four-year cycle trend according to Santiment. Some analysts believe the four-year market cycle is changing and that the halving schedule may no longer determine cyclical conditions as Bitcoin closes in on the mid point between halvings.The halving is when the amount of Bitcoin (BTC) rewards issued per new block mined is reduced by half. The next halving will happen around May 5, 2024, andl reduce block rewards to 3.125 BTC.According to author @Alerzio on the....

Related News

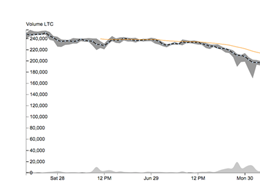

Litecoin is experiencing its biggest price slump ever. When the altcoin went mainstream, litecoin closely followed bitcoin's sometimes extreme price swings, peaking at $40 in late 2013, soon after bitcoin passed the $1,000 mark. However, in less than two months, litecoin has lost that close relationship with its golden sibling, prompting community members and some industry leaders to question litecoin's viability. Barry Silbert, Founder and CEO of SecondMarket, recently posted the following tweet raising the issue: Litecoin price appears to be decoupling from bitcoin. Money rotating out of....

Bitcoin price remains nearly 10% below recent highs, as the major cryptocurrency continues its slump after early last week’s sell off. Since hitting a new all-time high of $61k, BTC has continued to face downward pressure, hovering around the $54,000 price level. The past week’s volatility has resulted in bulls losing nearly $2.6 billion in liquidations, according to ByBt. Understanding Bitcoin’s Recent Price Action There were two major catalysts that led to last week’s sizable […]

Update: Today’s price low has been corrected from the earlier reported $887 to $885.41. After months of a sustained bullish rally, bitcoin price has swung to a significant slump, hitting a low of $885.41 on the Bitstamp Price Index (BPI) today. The dramatic drop comes within a day of bitcoin inching close to its all-time high. The first signs of a collapse began at 09:00 (UTC), when bitcoin was trading at $1,134.78. A thirty-minute trading period saw price fall quickly toward $1,068.84 before rebounding above the $1,100 mark an hour later. Come midday, things took a turn further south as....

The bitcoin price has continued to drop overnight on major bitcoin exchanges. The price on exchanges included in the Bitcoin Price Index all currently sit below $700, with the BPI overall having dropped almost 20% to $670 since close of play last night, and BTC China's price seeing a low of ¥4,003 ($658) this morning. The price slump follows the statement from the People's Bank of China and the news that divisions of Baidu and China Telecom, two of the best known names in Chinese internet and telecommunications, removed references to bitcoin payments from their sites. Analysis of the....

Bitcoin's block reward halved for the second time last week, from 25 to 12.5 bitcoins. The event, commonly referred to as “the halving” (or sometimes: “the halvening”), was a key moment in Bitcoin's history. Such halvings are scheduled to occur once in about every four years, and they ensure that no more than 21 million bitcoins will ever be in circulation. Unsurprisingly, the halving was highly anticipated, and predictions on how the event would impact the Bitcoin ecosystem abounded. One week since the second halving, this is the aftermath. Price. Perhaps the most debated issue leading up....