Group of Investors Seek to Buy Mt. Gox And Revive It

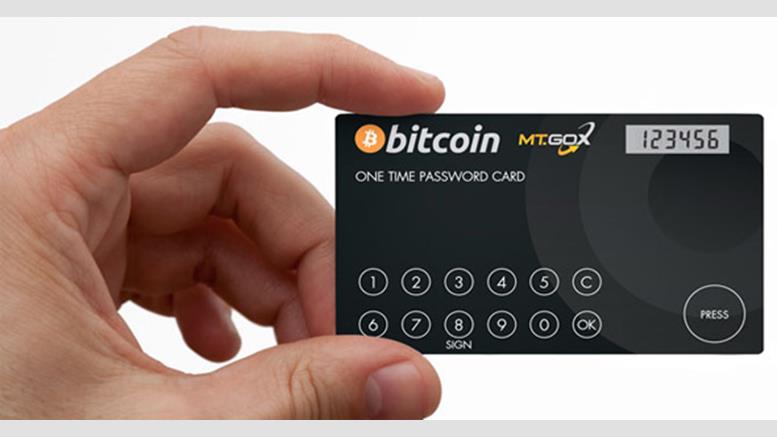

The Wall Street Journal reports (paywall) this evening that an investor group "with Hollywood ties" is hoping to buy out disgraced bitcoin exchange Mt. Gox for a whole bitcoin. Yes, you read correctly. One bitcoin, or about $390 at the currency exchange rate. The investors, one of which included former child actor Brock Pierce hopes to bring the exchange back to life. Other investors in the group include William Quigley of Venture Partners, and John Betts, who previously worked on trading systems at big-name firms like Morgan Stanley and Goldman Sachs. Such an acquisition would however....

Related News

With news this week that disgraced bitcoin exchange Mt. Gox would be liquidated due to complexities in the rehabilitation process, it seemed like the story was just about over for the company. U. S. investors are hoping to keep it going, it seems, attempting to convince a Japanese bankruptcy court to allow them to keep Mt. Gox alive and proceed with the rehabilitation process. The investors have launched a website for their initiative aptly named 'SaveGox.com', outlining their plan for a re-launch of the service with plans to establish a recovery fund to pay back investors who lost money....

Press Release: The Revive Project’s PULSE token public sale offers the crypto community a chance to be a part of and benefit from its unique investment platform and NFT marketplace. September 7th, 2021, Zug, Switzerland — The Revive Project is a revolutionary platform that will allow the blockchain community to come together to invest in […]

PRESS RELEASE. The Revive Project’s Unique ecosystem offers the crypto community a chance to be a part of and benefit from its unique investment platform and NFT marketplace. Zug, Switzerland — The Revive Project is a revolutionary platform that will allow the blockchain community to come together to invest in crypto and develop exciting NFT projects. Revive has created an unique ecosystem for NFT and crypto investments, governed by its native utility token, PULSE. The ecosystem uses a 10% transfer commission to benefit its community of users in a variety of different ways.....

Bitcoin prices experienced a sudden surge earlier last week. The price which was hovering at around 225 USD to 227 USD suddenly shot up to cross 250 USD. So what caused the sudden surge and what does it imply? First, let us get to the bottom of the price gain and to do that, we need to have some knowledge of current world affairs, especially in Europe (which most of us might already know). One of the nations in the European Union (EU), Greece has been in troubled waters for a while now. The country started experiencing an economic slowdown in 2008 and the condition has been deteriorating....

Just a few days ago, it was reported that American investors were hoping to acquire and revive disgraced bitcoin exchange Mt. Gox for one bitcoin (saying they would later relaunch and repay investors). This morning, we're getting some more information on the topic via the Wall Street Journal. According to John Betts from Sunlot Holdings (one of the investors involved with the proposed acquisition), creditors who owned over 70 percent of the bitcoins stored on the Tokyo-based exchange are in support of the idea to revive the operation. That, of course, must first be approved by a bankruptcy....