Bitcoin crashes below $30K, but on-chain data suggests accumulation is brewing

Despite the Bitcoin markets slipping below $30,000, on-chain data suggests accumulation may be underway, as $1 billion worth of BTC leaves exchanges each month. Despite Bitcoin crashing below $30,000 for the first time in one month, on-chain metrics suggest whales may be steadily accumulating BTC.According to Glassnode’s July 19 “The Week On-Chain” report, the Bitcoin reserves of centralized exchanges have continued to evaporate despite the recently sustained bearish momentum, with an average of 36,000 Bitcoin (worth roughly $1 billion) being withdrawn from exchanges monthly. Glassnode....

Related News

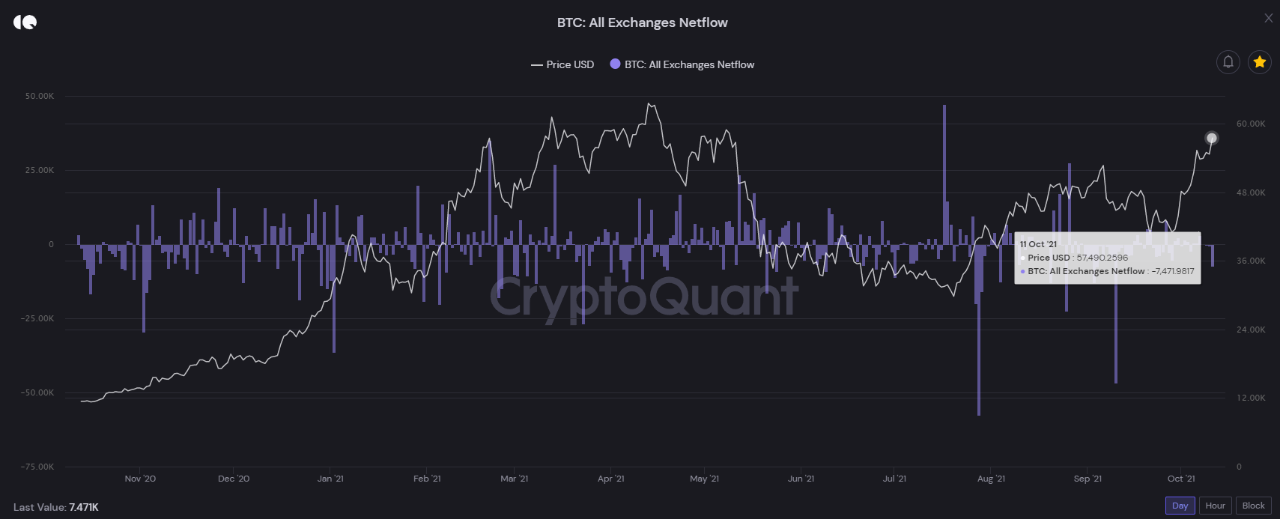

Bitcoin on-chain data suggests accumulation is going on as investors feel FOMO about the current rally above $57k. Bitcoin Accumulation Goes On As Investors Feel FOMO As explained by a CryptoQuant post, on-chain data is showing signs of accumulation as BTC netflows show negative spikes, and the stablecoins inflows indicate big moves. The Bitcoin netflow […]

On-chain data shows all Bitcoin investor cohorts have pivoted to distribution recently, an indication that a shift in market mood has occurred. Bitcoin Accumulation Trend Score Has Turned Red For All Holders In a new post on X, on-chain analytics firm Glassnode has talked about the latest trend in the Accumulation Trend Score of Bitcoin for the various investor cohorts. The Accumulation Trend Score measures, as its name suggests, the degree of accumulation or distribution that BTC holders are participating in. Related Reading: 215% PENGU Rally Incoming? Analyst Says Token ‘Inches’ From....

On-chain data suggests the Toncoin whales have participated in significant accumulation over the past week, which could be bullish for TON. Toncoin Whales Have Bought Large During The Last Seven Days As explained by analyst Ali Martinez in a new post on X, Toncoin whales have been active with net buying recently. The on-chain indicator […]

On-chain data shows the Bitcoin Accumulation Trend Score has observed a decline recently, a sign that investor cohorts have taken to selling. Bitcoin Accumulation Trend Score Is Currently Sitting At 0.21 In a new post on X, the on-chain analytics firm Glassnode has shared an update on how the Accumulation Trend Score has recently been looking for Bitcoin. The “Accumulation Trend Score” refers to an indicator that tells us about whether the Bitcoin investors are accumulating or not. Related Reading: Bitcoin Not Reached ‘Extreme Euphoria’ Phase Yet, Glassnode Reveals The....

On-chain data shows Ethereum whales have recently ramped up their accumulation, a sign that could be bullish for the asset’s price. Ethereum Whales Have Been Buying Big According to data from the on-chain analytics firm Glassnode, the Ethereum whales have been participating in a very significant amount of accumulation during the past week. Related Reading: […]