Public Miners Start Selling Bitcoin Treasuries

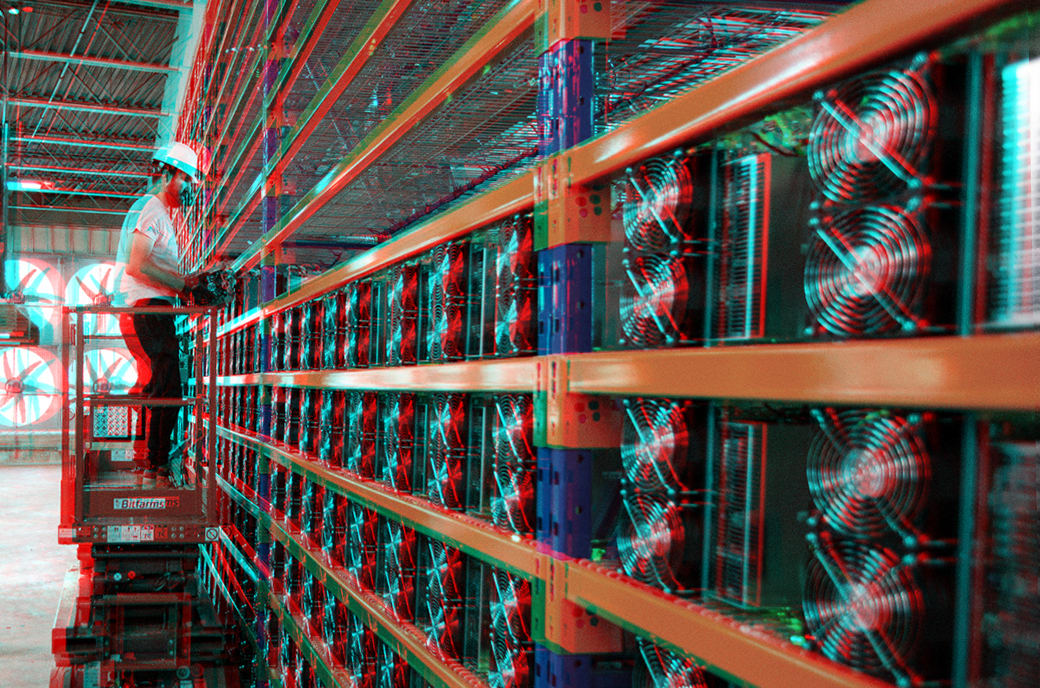

As June monthly production updates roll out over the next week, Core Scientific and Bitfarms have both sold nearly 50% or more of their bitcoin treasuries. The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.Core Scientific Sells 7,202 BTCOn July 5, 2022, Core Scientific, the world’s third-largest publicly traded bitcoin miner by market cap ($525.52 million) announced in its June monthly update....

Related News

Data shows public Bitcoin miners dumped around 14.6k BTC during the month of June, which is about 25% of their total holdings. Bitcoin Public Miners Capitulate As Mining Revenues Stay Quite Low As per the latest weekly report from Arcane Research, BTC miners sold almost 400% of their production during the last month. Miners pay off their electricity bills, expansions, and other running costs using dollars. As such, the USD value of their Bitcoin rewards is the more relevant metric for them. Since the price of the crypto has been in a state of decline during the last few months, times have....

Selling pressure had been mounting on public bitcoin miners over the last couple of months. This was a direct result of the decline in the price of the digital asset, which saw the cash flow for bitcoin miners plummet significantly. It came out to an over 60% decline in profitability, and given that miners continue […]

During the last year, there’s been a lot of discussion concerning bitcoin treasuries or public firms putting bitcoin on their balance sheets. However, the leading crypto asset by market valuation is not the only digital currency being held by treasuries. Ethereum has become a prominent treasury asset as a number of companies are known to hold the second leading crypto in their reserves.

Ethereum Treasuries Have Grown

According to the bitcoin treasuries list, exchange-traded funds, countries, public companies, and private firms own 1,559,047 bitcoin (BTC) worth roughly $66....

Bitcoin miners have borne the brunt of the bear trend since it began. They watched cash flow plummet on their machines, forcing them to look to other ways to finance their operations. The natural response to this was for public miners to dip into their bitcoin reserves and begin selling off BTC to keep their operations going. For a time, it seemed miners would stop selling due to the recovery in price, but this is proving not to be the case. Miners Offload More BTC Bitcoin miners had sold off more bitcoin than they had mined for the first time in May. The same trend then continued into....

Data shows Bitcoin treasury companies have seen an explosive growth trajectory since 2023, gaining relevance as an important pillar of the market. Public & Private Companies Now Hold More Than A Million Bitcoin In a new post on X, on-chain analytics firm Glassnode has talked about the trend in the Bitcoin treasuries held by public […]