US Bond Markets Signal Economic Downturn, Trend Forecaster Says if War Ensues...

As Americans continue to deal with rising inflation, on Tuesday the spread between 2-year and 10-year Treasury yields inverted, signaling the U.S. economy may be headed for a recession. This week, a myriad of financial reports have noted that the U.S. dollar’s reserve currency status could be undermined. Moreover, there’s also the possibility of crude oil prices reaching upwards of $250 per barrel, according to a top hedge fund manager. Ominous Inverted Yield Curve Sends Recession Signals, While the Dollar’s Reserve Currency Status Is Questioned On March 29, a closely....

Related News

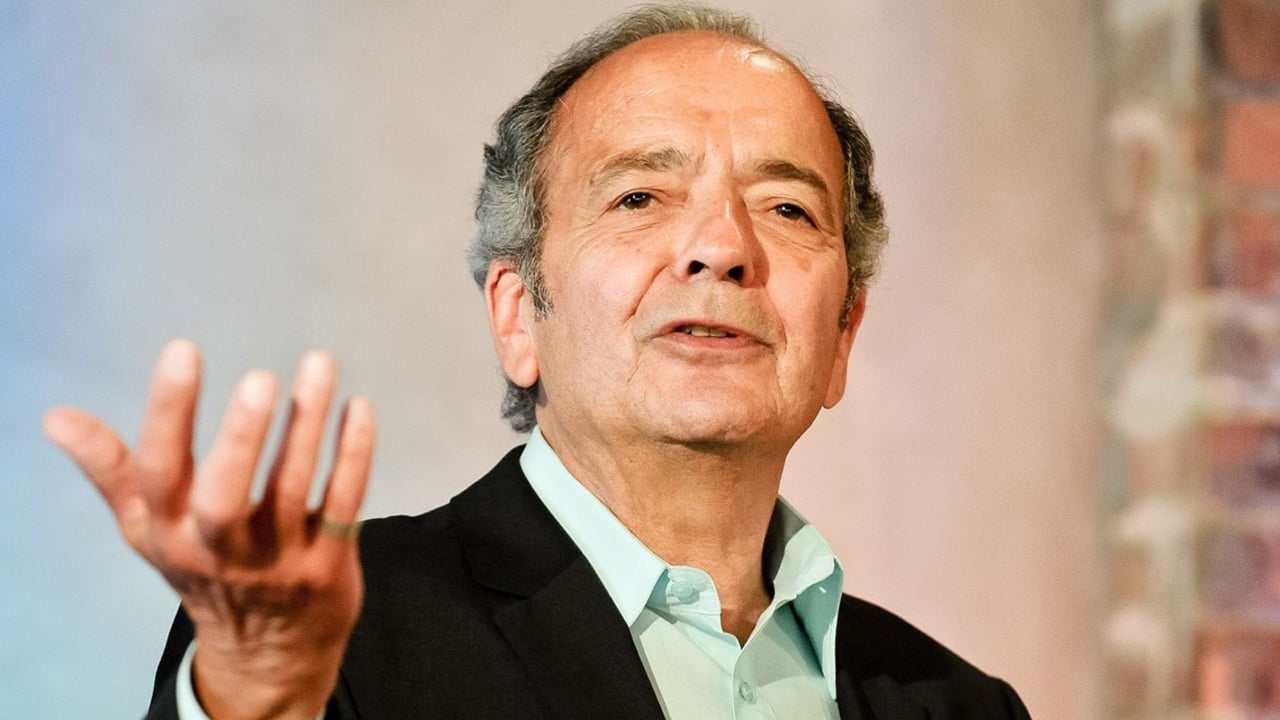

This week Bitcoin.com News spoke with Gerald Celente, the popular trends forecaster, and publisher of the Trends Journal. During a telephone conversation, Celente discussed the uncertainty surrounding the global economy after governments worldwide locked down the world’s citizens over the Covid-19 pandemic, shut down businesses and injected trillions into the economy. The discussion touches upon gold, bitcoin, the pandemic, the Ukraine-Russia war, and the Federal Reserve. The trends forecaster believes that World War III has already begun, and if people do not assemble to bolster....

According to a recent report produced by Dappradar, the Web3 gaming industry has managed to raise $750 million since August 1st in spite of the crypto downturn, with several important projects registering positive numbers regarding sales and activity.

Web3 Gaming Industry Thriving Amidst Economic Downturn

The current economic downturn that is affecting the traditional and cryptocurrency markets has had a less significant effect on the Web3 gaming sector. According to a recent report issued by Dappradar, the numbers coming from this industry have been positive, resisting the....

From ominous speculation about the potential economic fallout of military conflict between Taiwan and China, to markets being flooded with designer watches in the wake of a crypto downturn, to warnings of worse bear markets and soccer franchises pushing forward in the realm of metaverse ambitions, there’s once again never a dull moment in the world of cryptocurrency news. Without further ado, this is your bite-sized digest of the week’s hottest stories from Bitcoin.com News.

Reports Say Beijing Attacking Taiwan Could Lead to ‘Far-Reaching Economic....

The bond markets are rattled and global yields are rising, signaling a possible reversal of an aging 33 year bull market in bonds that could have a major impact on all other global financial markets resulting in a reprice in asset classes across the board. The price of bonds has been falling in dramatic fashion and the reason for this has varied. Some speculate the bond markets smells economic growth picking up in the second half of 2015, while others believe inflation expectations are picking up. Bond market liquidity (or the lack thereof) has been identified by many market experts as the....

Following the extremely volatile European markets during the past few days and the euro and pound dropping rapidly against the U.S. dollar, the Bank of England has decided to intervene in bond markets. U.K. government bond yields have been erratic and the pound sterling also dropped to a lifetime low against the greenback. On Wednesday, the Bank of England noted that it was monitoring the “significant repricing” of U.K. assets very closely. Bank of England Opens the Stimulus Flood Gates Again — Central Bank Intervenes in UK Bond Markets The Bank of England (BOE)....