Increasing Bitcoin Block Size vs. Higher Transaction Fees

Now that the number of Bitcoin transactions is increasing for an unknown reason, a new debate has started to form on Reddit. Is it harder to increase the number of transactions on the Bitcoin network compared to increasing the transaction fees, or vice versa? On paper, the second option will meet a lot more resistance from the community, but as displayed....

Related News

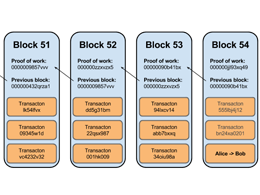

In October of 2014, Gavin Andresen sparked a community-wide debate over the future of the hard-coded, 1 MB size-cap on Bitcoin blocks. Andresen proposed a change to the Bitcoin protocol that would implement an upward-scaling block size limit, necessitating a hard-fork of the blockchain. Many people opposed this idea — mainly on economic grounds. They argued that a constantly increasing block size limit would make the supply of block-space far outstrip the demand for transactions, which would greatly diminish transaction fees. Falling transaction fees would become a severe problem once the....

Everyone is entitled to their opinion, but sometimes people say things that just don't make sense. Jon Matonis had such a moment this morning on Twitter. Here he goes, before much more is written here: This might be how we know that the block size debate is getting out of control when people have the opportunity to make such presumptuous statements as that. At no time has any prominent proponent of increasing the block size spoken of increasing the block reward or removing the 21 million coin limit. Bitcoin Core development is not a central bank, and, as at least one person told Matonis on....

There has been an ongoing Bitcoin block size debate, and most recently a radical, old idea resurfaced: instead of increasing the block size from 1MB to 2,4 or 8MB, the protocol should be changed to accommodate 32MB blocks. This probably pissed off Bram Cohen. Are 32MB Blocks Too Big? Here’s why that’s not a radical idea: it’s how Satoshi Nakamoto, creator of Bitcoin, for a time had designed Bitcoin before settling on a 1MB transaction size — a decision which, perhaps, led to Bitcoin being christened “digital gold.” Calls for large block sizes are not so uncommon: Gavin Andresen himself....

In this article I will explain how the size of Bitcoin blocks is determined in the absence of an arbitrary size limit. Oleg has already written an excellent post on this topic, but I have a few things to add and I wish to relate the discussion to the current debate over increasing the block size. If the maximum limit on block size is removed, it is not the case that blocks will simply grow without limit. There is a natural size that is determined by the market. The block size will change until the marginal revenue of adding more transactions approaches the marginal cost; this could happen....

The average bitcoin transaction fee currently stands at 10280 satoshis. Micropayment channels can drastically reduce transaction costs for multiple bitcoin transactions across 2 parties. The Bitcoin network is weighed down by increasing number of transactions over the blockchain. Thanks to the smaller block size of 1 MB, which has not been upgraded since the days of Bitcoin’s creation. The increased load on the network has led to delays in confirmation of transactions. Miners have started to give priority to transactions with higher miner fee, leading to an increase in the average miner....