Appcoins, Crypto Crowdfunding, and the Potential SEC Regulation Pitfall

A quick scan of any popular cryptocurrency forum will reveal numerous announcements for crowdfunding campaigns intended to support the launch of a new altcoin or decentralized application. In these crowd sales, digital tokens associated with the application (called “appcoins”) are sold to early adopters in an effort to raise capital for the new project. The hope of many who purchase appcoins in a crowd sale is that the price of the coin will go up significantly if the application becomes widely adopted. In response to these crowdfunding campaigns, some have warned that certain appcoins....

Related News

ING Bank, just as any other, is just an unnecessary middleman between you and many crowdfunding options. Today, we have things like the Lighthouse, WeiFund or Koinify, which try to help those seeking to receive crowdfunding for interesting projects. There is no need for using centralized crowdfunding anymore, nor is there a need for banking assistance in....

Initial coin offerings (ICOs) and appcoins are a hot topic in the blockchain community these days. Forward-thinking investors have thrown their support behind the movement, thought leaders have proclaimed that ICOs are turning the traditional venture capital model on its head, and bitcoin industry veterans have launched hedge funds to invest in blockchain tokens. I expect this discussion and activity to gain momentum in 2017, but I remain skeptical. As the most active investor in blockchain startups, we at Digital Currency Group are uniquely positioned to capitalize on the growth of ICOs.....

Could bitcoin be a suitable vehicle for crowdfunding? Over the past couple of years, crowdsourced funding projects have bloomed, but most of them still require contributions in fiat currencies. Now, however, some sites are emerging designed to help people attract bitcoin-based funding from a broad community of donors. Crowdfunding platforms such as Kickstarter and IndieGogo have become a popular means of funding for a range of projects, from manufacturing through to content production. According to market analyst Massolution, crowdfunding platforms raised $2.7 billion in 2012, 81% up on....

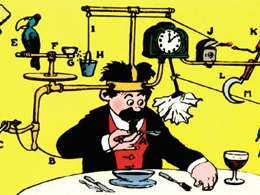

Appcoins. What a great way to fund an open source project, right? The idea began with Mastercoin, but seems to have jumped from there to become its own meme. You just create an app, and then make it less convenient by creating a cryptocurrency (or “appcoin”) that is required to use it, some of which you sell to investors to pay for development of the app. There’s no way that couldn’t work! It’s just like selling stock in a company, right? Wrong. As will be shown, whereas the value of a stock is related to the value of the company that issued it, there is no such connection between an....

While in the long-run there will likely be new opportunities that open up, below are real, present risks involving the cryptocurrency world, especially with those individuals developing appcoins and crowdfunding/crowdequity platforms. For instance, section III of the JOBS Act has not been written up, let alone implemented. As a Swiss friend in finance likes to remind me: Rule #1 of Bitcoin: do not believe any news about Bitcoin -- always do your own research. And in this case, talk to an attorney. In the event of lawsuits, not everyone has enough money to live abroad and permanently hang....