Bitcoin Analysis: Week of Oct 12 (Don’t Blame the Bearwhale)

In last week’s post we concluded with the following statement: Our overall stance remains Long-Term Bearish (with still limited downside), Intermediate-Term Bearish, but for the 3rd week in a row we are flipping Short-Term to now be Bullish. The previous 2 weeks worked out as planned so let’s see if this week is kind to the arrows on the charts. The overall picture still remains very weak for any meaningful reversal at this time. The highest probability move right now is a rebound back to the US$400 area. Even if the price breaks down this weekend into the US$340-350 zone, the fact that....

Related News

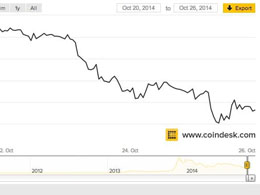

Traders appear to have been reinvigorated by blood in the water this week in the aftermath of the slaying of the 'BearWhale' last Monday. The bitcoin price was $327 at the start of last week and it was trading for $370 at the week's end, according to the CoinDesk Bitcoin Price Index. After weeks of tepid trading volumes, bitcoin exchanges showed a surge in orders, hitting 642,000 BTC on 9th October. This almost topped the 657,000 BTC in total trading volume at the height of the buying activity as the massive sell order of 26,000 coins was unloaded by the so-called BearWhale on the market....

Jeremy and many others don't trust Bitcoin. I was at Hope College this week for their annual Model United Nations conference and I decided to make the best use of my time by investigating the minds of these youthful thinkers. I also got a surprise opportunity to ask former Representative of Michigan's 2nd district, Pete Hoekstra, about Bitcoins at his dinner speech on Global Terrorism. People came from all over the state of Michigan and the answer is essentially the same. I don't trust it! So what will it take for Bitcoin to gain the trust of the general populous? Well, I interviewed a....

I walked up to a businessman friend a few days ago and asked him point blank: “Do you know what bitcoin is?” He stared at me and blinked twice. He really didn’t need to reply, his facial expression was a dead giveaway. He didn’t have a clue. Here lies the problem, when many of us Filipinos, rich and poor alike, are struggling to get out of the so-called rat race of eat-sleep-work-pay-bills, we do not have any inkling of the advances in finance, investments and technology that could help us in our quest to financial freedom. Blame it on the banks for never introducing us to such concepts....

The Binance CEO was responding to a questioner who accused the company of profiting from FTX’s downfall while normal users suffered. During an ask-me-anything (AMA) session on Twitter Spaces on Nov. 14, Binance CEO Changpeng Zhao, also known as CZ, urged crypto users to take responsibility for their investment decisions and not put all of the blame on others when things go south.“As a user, you also have responsibility — you can’t just blame all of the responsibility to other people. When bad things happen, if you blame all of the responsibility, if it’s always to other people, you will....

Bitcoin price resilience finally crumbled this week after two weeks of strength following the so-called 'BearWhale' slaying. The price opened the week at $386, holding steady until mid-week, when it began a steep decline. It closed at $346, shedding $40 over the last seven days. The bitcoin price deterioration follows a strong rally from $295 on 6th October to a high of $405 about a week later. Trading held steady until this week's drop, even as the wider financial markets tumbled in mid-October. Swaps activity spikes. A look at the swaps activity on Bitfinex reveals more bearish....