Australia’s ‘Big Four’ Bank ANZ Integrates Contactless Payment Feature

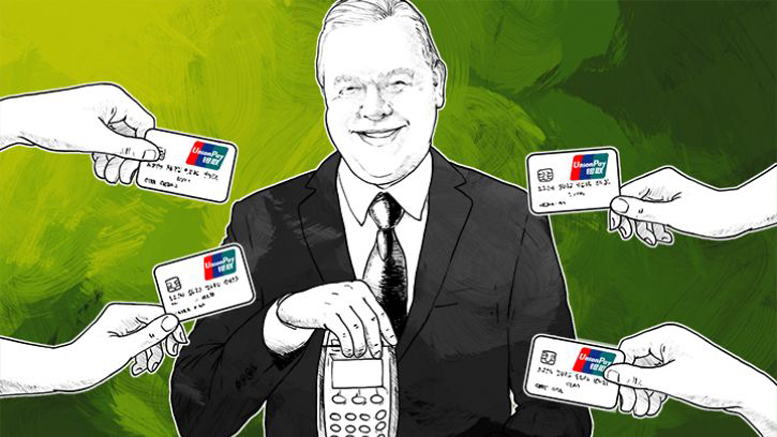

Australia's big four bank, the Australia and New Zealand Banking Group (ANZ), has announced it will implement China's UnionPay contactless payment feature QuickPass to ANZ electronic funds transfer at point of sale (EFTPOS) terminals and ATMs throughout the Austrasia region. China's UnionPay is moving forward with its global expansion plans, announcing yesterday it had concluded a deal with ANZ that would find the bank implementing UnionPay's QuickPass contactless capability to 90,000 ANZ EFTPOS terminals across Australia. The feature will be deployed to New Zealand by the end of 2015,....

Related News

A petition to collectively bargain and boycott Apple on Apple Pay by three of Australia’s “big four” banks is set to be dismissed by the Australian Competition and Consumer Commission (ACCC), the country’s antitrust regulator. Fintech is all the rage and Australia’s big banks want in, by demanding access to Apple’s in-house Apple Pay platform with their own terms. The Commonwealth Bank, the National Australia Bank and Westpac are three of Australia’s ‘big four’ banks complaining that Apple is barring them from gaining access to its Apple Pay platform, after negotiations between the banks....

Australia’s so-called “Big Four” banks will be closely monitored for any attempts to purchase Fintech or blockchain-based startups by the country’s competition regulator. The Australian Competition and Consumer Commission (ACCC) will scrutinize any dealings or attempts by Australia’s biggest banks to swallow Fintech companies developing technologies like blockchain solutions in the financial sector, revealed the body’s chairman Rod Sims. As has been the predominant narrative for well over a year now, the Fintech revolution is seen as the banking industry’s biggest disruptive threat.....

The world of finance and technology is constantly evolving, and traditional institutions have to play catch-up in this game to stay relevant. Contactless payments have been touted as one of the most revolutionary financial innovations of the past decade, and many consumers are eager to be part of this experience. An upcoming test by BNP Paribas will experiment with contactless payment displays. Despite the appeal of contactless payments, this level of innovation in the financial sector slowly removes any human interaction from the shopping experience. Rather than chatting with the cashier....

Contactless payments are one of the hottest trends right now when it comes to revamping the financial industry in the near future. However, the payment method is only viable in a limited capacity right now, although more consumers will be able to use contactless payment options in the future. If everything goes according to plan, most of the New York public transportation system will go contactless in two years from now. When using public transportation, cash payments are one of the most annoying issues to deal with. While most countries will have other ticketing options available as well,....

The payment world has evolved from cash transactions into a cashless ecosystem, as customers want to check out and pay for their goods with as little friction as possible. Contactless payments are on the rise in various countries, and in the United Kingdom, the average contactless payment transaction limit has been increased by 50%. Regardless of this change, additional infrastructure is required for merchants who want to make use of this system. In the United Kingdom, card payment terminals are a very common sight, as less consumers use cash payments year over year. From a convenience....