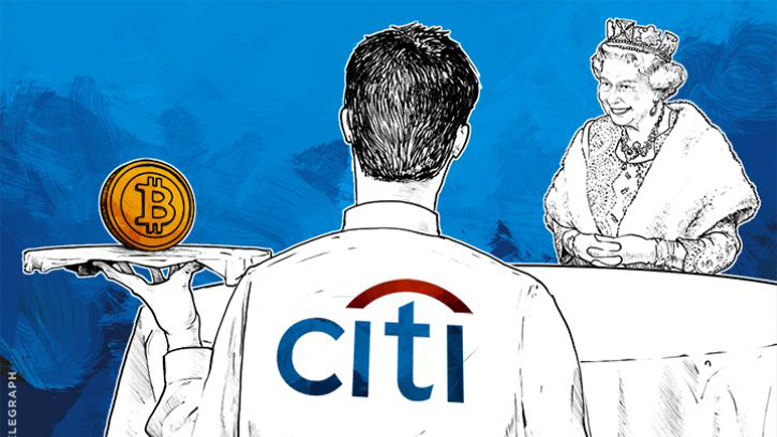

Citi Calls on UK Gov’t to Launch ‘Inevitable’ Digital Currency

Leading global bank Citi has called on the government of the United Kingdom (UK) to adopt a digital form of legal tender to reduce the cost of moving money, increase consumer spending and add greater liquidity to the market. Citi made the request in a response, obtained by CoinDesk, to the government's public call for Information on digital currencies from the UK Treasury made in November, which asked for views on the risks and benefits of cryptocurrencies such as bitcoin. The aim of the consultation is to in order to decide whether the UK government should support innovation in the area....

Related News

The United Kingdom, is often one of the friendlier places when it comes to Bitcoin legality, especially when compared to US regulation, such as the New York BitLicense. Citi, a global banking and financial corporation, recommended that the UK take its acceptance one step further with the creation of a UK cryptocurrency. In a document submitted by Citi to the British government, Citi noted the risks involved with digital currency. However, Citi also mentioned the untapped possibilities that digital currencies like Bitcoin can offer:

Citi GPS, an operation operated by multinational financial outfit Citi, has come out with a report that looks at the institutional environment, enabling infrastructure, solution provisioning and propensity to adopt digital money to measure the readiness for digital money in a number of countries. The report also quantified the benefits of digital currency adoption for businesses, individuals and governments. The countries that are the most

Around the same time as Accenture's call for the UK government to regulate bitcoin wallets, Citi suggested that officials should look into creating their own digital currency. This has been revealed in the Treasury's release of a document entitled "Digital Currencies: Response to the Call for Information". This report summarizes all the submissions received by the government after it urged the public to assist them in understanding the workings of the digital currency industry. The Treasury received more than 120 responses and has outlined the proposals and the government's next steps.....

Citi has told the UK government it should consider creating its own digital currency, a newly obtained document has revealed. The document, a response to the Treasury's call for information on digital currency, was obtained by CoinDesk via a Freedom of Information request. In the response, the global bank's Treasury and Trade Services (TTS) Technology and Innovation Team states: "The greatest benefits of digital currencies can be realised through the government issuing a digital form of legal tender. This currency would be less expensive, more efficient and provide greater transparency....

Bitcoin’s blue-chip coverage just turned decisively bullish. Within hours of each other on October 2, JPMorgan and Citi outlined upside paths that put six-figure levels squarely on the 12-month horizon, framing the next phase of the cycle around volatility normalization versus gold and sustained institutional demand. New 12-Month Bitcoin Calls From Citi And JPMorgan JPMorgan […]