WPCS Announces Financial Results for the Three and Nine Month Periods Ending January 31, 2014

WPCS International Incorporated (NASDAQ: WPCS), which specializes in contracting services for communications infrastructure and the development of a Bitcoin trading platform, today announced its fiscal 2014 financial results for the three and nine month periods ending January 31, 2014.

Sebastian Giordano, Interim CEO of WPCS, commented,

"Since the launch of BTX Trader ("BTX") in December 2013, we have continued to make significant progress in the roll-out of our Bitcoin trading platform. Today, our platform remains available for free download on our Windows-based desktop application. The next phase of our platform development is to allow access to the beta version via the web. We will begin generating revenue from this platform during the second quarter of calendar year 2014."

Mr. Giordano continued,

"In addition to the successful beta launch of BTX, our primary objective continues to be in stabilizing operations, improving cash flow and strengthening our balance sheet. Since implementing an aggressive turnaround strategy in August 2013, we have made significant strides, in part, by divesting and closing underperforming operations, reducing expenses and improving performance in our ongoing contracting operations. We believe this strategy has and will continue to improve our financial condition and be beneficial towards future shareholder value."

Year-to-Date Company Highlights:

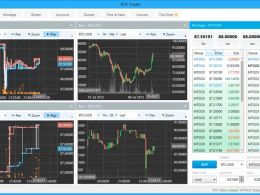

- Acquired BTX, the first trading platform to enable Bitcoin traders and industry researchers to access market data and execute orders on the five most popular Bitcoin exchanges on a single application;

- Launched the beta version Windows-based trading platform available at www.btxtrader.com;

- Achieved a 26.1% increase in YTD revenues from its remaining continuing operations within its legacy business, including a 27.3% increase from our two profitable domestic subsidiaries;

- Increased shareholders' equity by approximately $8.1 million from a deficit of approximately $900,000 at April 30, 2013 to equity of approximately $7.2 million at January 31, 2014; and,

- Improved working capital by approximately $2.6 million, from a deficit of $500,000 at April 30, 2013 to a positive position of $2.1 million at January 31, 2014, which consisted of current assets of $16.6 million and current liabilities of approximately $14.5 million.

Financial Results for the Three Month Period Ending January 31, 2014

For the third quarter of fiscal year 2014 ended January 31, 2014, WPCS reported revenue of approximately $8.3 million, an increase of 9.5% compared to revenue of $7.6 million for the same period in the prior year. This increase was partially offset by an $835,000 decrease in revenue in our Trenton Operations due to the strategic wind-down of this unprofitable operation, which commenced in September 2013. Excluding the decrease for the Trenton Operations, the effective increase in revenue from the remaining Suisun City, Seattle and China operations was approximately 23.2%.

For the third quarter ended January 31, 2014, WPCS reported a net loss to common shareholders of approximately $3.6 million or $0.55 per diluted share, of which approximately $3.4 million of the net loss was attributable to: $2.5 million of non-cash interest expense charges related to the accelerated amortization of debt discount from the conversion its senior secured convertible notes during the third quarter and which do not affect the operating cash flow of the Company; a $290,000 loss from discontinued operations for the Australia, Lakewood and Hartford Operations; operating losses of $347,000 from the initial start-up of the Bitcoin trading segment; and operating losses of $248,000 from the wind-down of the Trenton Operation. The net loss for the third quarter ended January 31, 2014, compares to a net loss of $1.2 million, or $1.24 per diluted share, for the same period one year ago.

Financial Results for the Nine Month Period Ending January 31, 2014

Revenue for the nine months ended January 31, 2014 was approximately $23.5 million, as compared to $26.8 million for the nine months ended January 31, 2013. This decrease in revenue was due primarily to an $8.1 million decrease in revenue in our Trenton Operations due to the strategic wind-down of this unprofitable operation that commenced in September 2013. Excluding the decrease for the Trenton Operations, the effective increase in revenue from the remaining Suisun City, Seattle and China Operations was approximately 26.1%.

The net loss attributable to common shareholders was approximately $10.0 million, or $3.41 per diluted share, for the nine months ended January 31, 2014, of which approximately $9.0 million was attributable to: one-time charges of $1.5 million related to severance expense recorded per the separation agreement with former CEO Andrew Hidalgo; $4.3 million of non-cash interest expense for the amortization of debt discount and expenses related to the conversion of senior secured convertible notes (the "Notes") and the amendments to the Notes and Warrants (the "Amendment and Note Amendment"); $1.3 million related to the loss on extinguishment of the Notes; $834,000 related to the final change in fair value of the derivative liabilities associated with the Notes and Warrants prior to the Amendment and Note Amendment, which enabled us to reclassify the former derivative liabilities to stockholders' equity; a net loss of approximately $330,000 from discontinued operations for the Australia, Lakewood and Hartford Operations ; approximately $347,000 in operating losses from the initial start-up of the Bitcoin trading segment; and approximately $366,000 of operating losses from the wind-down of the Trenton Operation. Such net loss for the nine months ended January 31, 2014, compares to a net loss attributable to common shareholders of $724,000, or $0.73 per diluted share, for the nine months ended January 31, 2013.

Shareholder Update Conference Call

Management will host a shareholder update conference call in early April 2014. Details, including dial-in and webcast information, will be provided in an upcoming news release prior to the call.

About WPCS International Incorporated

WPCS operates in two business segments including: (1) providing communications infrastructure contracting services to the public services, healthcare, energy and corporate enterprise markets worldwide; and (2) developing a Bitcoin trading platform.

For more information, please visit http://www.wpcs.com/ and http://www.btxtrader.com/

Statements about the company's future expectations, including future revenue and earnings and all other statements in this press release, other than historical facts, are "forward looking" statements and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve risks and uncertainties and are subject to change at any time. The company's actual results could differ materially from expected results. In reflecting subsequent events or circumstances, the company undertakes no obligation to update forward-looking statements.

| WPCS INTERNATIONAL INCORPORATED AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

| (UNAUDITED) |

| Three Months Ended | Nine Months Ended | ||||||||||||||||

| January 31, | January 31, | ||||||||||||||||

| 2014 | 2013 | 2014 | 2013 | ||||||||||||||

| (Note 1) | (Note 1) | (Note 1) | |||||||||||||||

| REVENUE | $ | 8,296,132 | $ | 7,573,275 | $ | 23,483,259 | $ | 26,819,535 | |||||||||

| COSTS AND EXPENSES: | |||||||||||||||||

| Cost of revenue | 6,227,892 | 5,173,016 | 17,574,888 | 19,141,228 | |||||||||||||

| Selling, general and administrative expenses | 2,278,433 | 1,674,268 | 6,116,248 | 5,830,550 | |||||||||||||

| Severance expense | - | - | 1,474,277 | - | |||||||||||||

| Depreciation and amortization | 214,212 | 268,388 | 672,164 | 840,674 | |||||||||||||

| 8,720,537 | |||||||||||||||||

Related News